THE AMERICAN DREAM

***This random double-opt in survey was conducted by OnePoll, a market research company and corporate member of ESOMAR and adheres to the MRS code of conduct. For more information about OnePoll’s research in the media, navigate to their portfolio here: http://www.onepoll.com/in-the-media/

News Copy - WITH VIDEO & INFOGRAPHIC: https://we.tl/0Wst8USDWi

Do you shop at Whole Foods? Pay for Netflix or Spotify Premium? You just might have made it in life...

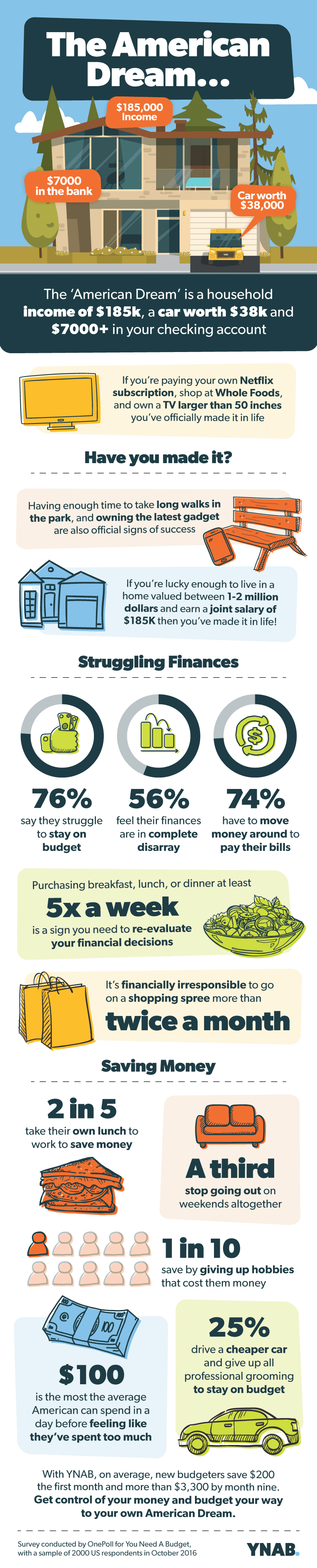

In today’s economy, the ‘American Dream’ can feel elusive. But according to new research, there are distinct milestones that the majority associate with having “made it” including a household income of $185k, a car worth $38k and a checking account with more than $7000.

The study by YNAB (You Need A Budget), a budgeting software and education company surveyed the financial aspirations of 2,000 Americans to quantify what the average ‘American Dream’ looks like today.

The research profiled what ‘making it’ in life looks like and found that it’s not all about the white picket fences –and you might be doing better than you think. In fact, if you’re paying your own Netflix subscription, occasionally shop at Whole Foods, and own a TV larger than 50 inches then, congratulations, a majority of your fellow Americans believe you’re ‘living the dream.’

Can you afford to pick up the tab after a night out with friends? Do you own a refrigerator with an ice dispenser? More signs that you’re living the American dream, according to results.

Having enough time to take long walks in the park, never having to make a bank transfer between accounts and owning the latest hot gadget are also considered official signs of success, according to the 2,000 people polled.

And, if you maintain at least $7,425 in your checking account, study results indicate, you are the envy of the masses and have achieved the American Dream.

Lindsey Burgess, a spokesperson for YNAB said: “Of course, “stuff” is easy to quantify, but we were excited to see proof that being in control of your money, and the freedom and convenience that affords, was recognized as a mark of success.”

“What we see again and again, is that a nice car will only contribute to your happiness if you can really afford it without being stressed about money.”

Unfortunately, for many that is not the case. In addition to struggling to keep their finances up to par, more than half of the country (56 percent) describes their finances as in complete disarray.

And of those who say they have a budget, 76 percent say they struggle to stick with it.

According to the research, an overdrawn account and constantly having to borrow money are the most common signs a person's finances are in disarray.

In fact, 74 percent of Americans have to move money around to even pay their bills - paying a portion of a bill one week, and the rest another week, along with making constant transfers between their savings and checking account.

Purchasing breakfast, lunch, or dinner at least five times a week are and eating out more than three times a week are also signs you might need to re-evaluate your financial decisions.

“The good news is, the whole purpose of a budget, is to help ensure you have money for the things that are most important to you. Whatever the “American Dream” is for you, a budget can help you get there,” says Burgess. “With YNAB, on average new budgeters save $200 after the first month, and more than $3,300 by month nine.”

It’s great to treat yourself occasionally, but respondents deemed it financially irresponsible to go on a shopping spree more than twice a month. While many Americans are resorting to cutting back wherever they can in order to be able to treat themselves.

Over four in ten (44 percent) take lunch to work to save money. Nearly a third stop going out on weekends altogether. One in ten goes the extra mile to save up by giving up on any hobbies that cost them money.

And a hundred dollars is the most the average American can spend in a day before feeling like they’ve spent too much money.

Driving a cheaper car and even giving up professional grooming are hardcore sacrifices about a quarter of Americans give up for the sake of staying on budget.

“Decide what you want and what is most important to you, and then focus your money toward those things. You might have to give something up, but it won’t feel like a sacrifice when you know it moving you closer to your big goals. And you aren’t stressed about money all the time!”

TOP SIGNS YOU’RE LIVING THE MODERN AMERICAN DREAM

Have a property valued between 1-2 million

$7425 in your checking account

Own a car worth $38,000+

$35k worth of savings

Household income of $185k+

Not having to worry if there are enough funds in your account

Being debt free

Able to go on weekend trips

Able to donate [money, clothes, etc.] to a charity

Able to pick up tab after a night out with friends

Having a holiday home

Voting

Planning a trip

Never having to make a bank transfer

Have flown first class

Go on at least two annual trips abroad

Having time to take a walk in a park

Own your own Netflix Subscription

Able to hire a home cleaner

Buying the latest gadget

Visiting a U.S. landmark/monument

Children in private school

Standing up for a case

Have lobster or steak at least once per month

Shop at Whole Foods

Own a TV larger than 50 inches

Own a home movie theater

Own a fridge with ice dispenser

Being able to call out of work

Going furniture shopping

This survey of 2,000 employed US adults was conducted between October 7th, 2016 and October 29th, 2016 by Market Researchers OnePoll and commissioned by YNAB.

END

![]()