By Zoya Gervis // SWNS

New York office - 646-873-7565 / usnews@swns.com

NEWS COPY w/ VIDEO & INFOGRAPHIC

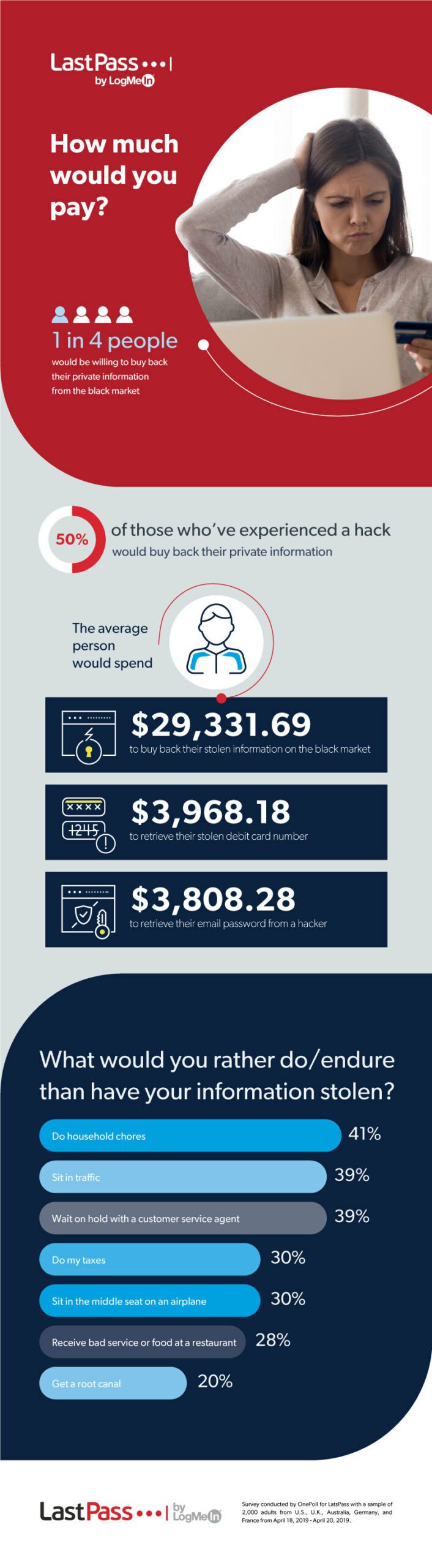

One in four people would be willing to buy back their private information from the black market, according to new research.

A study of 2,000 people explored the value placed on private information available online and keeping their passwords secure — and it found the number willing to buy back their information jumps to nearly 50 percent when asked of people who’ve previously experienced a hack.

In fact, a third are willing to shell out the big bucks if their personal information had been stolen. The average respondent revealed they’d be willing to spend $29,332 to buy back their stolen information on the black market.

Topping the list of things people value when it comes to personal information are debit card numbers. Americans would part ways with $3,968 to retrieve their stolen debit card number.

The study, conducted by OnePoll in conjunction with LastPass, explored the protections and password sharing habits of respondents in the U.S., U.K., Australia, Germany and France.

It discovered that globally, 28 percent have been the victim of a hack or stolen identity. But of the 1,000 Americans polled, that number jumps to 35 percent.

When it comes to passwords, people are willing to part ways with a lot of money to get their information back. The average respondent studied would be willing to shell out $3,808 to retrieve their email password from a hacker, while online banking passwords were a little less valuable but still important to people who were willing to part ways with $3,213.

Even while people know about the importance of having strong passwords, three in 10 (28 percent) revealed they make an effort to ensure some but not ALL of their passwords are very strong.

However, results revealed that people care more about creating strong passwords for financial accounts than social media. Over 70 percent of those studied revealed that when it comes to financial accounts like banking and stocks, the passwords they create are strong and complex.

While some people are being proactive, that doesn’t mean they are worry free. Nearly half of those studied (47 percent) admitted that they are worried their passwords can be easily hacked.

The worry most likely stems from the fact that two in five have not changed a single password in the last 12 months after a major breach was reported on the news.

“Passwords play a huge part in one’s overall security, but people continue to neglect basic best practices," said a spokesperson for LastPass. "Some of the most common ways people are leaving themselves vulnerable online is by using weak, easy to crack passwords, and then using those same passwords on many of their other online accounts.”

Having personal information stolen is a tough pill to swallow. Which is why 41 percent revealed they’d rather sit in traffic than have their personal information stolen, while a further third are happy to do their taxes if that would avoid having their personal information hacked or stolen.

But beyond what people would rather do than have their information stolen is what they’d be willing to give up. It turns out, 28 percent of respondents would much rather give up alcohol to prevent a breach of their personal information.

In fact, another one-third of the people surveyed revealed they’d happily forgo reality TV if that meant they’d keep their personal information safe and protected from a potential breach.

“To mitigate risk, one should use long, complex, ideally completely random passwords, that are unique to every service and website. Obviously, most humans would never be able to remember dozens of strong passwords, so this is where password managers, like LastPass, come to help," added a spokesperson for LastPass.

“Password managers make it very easy to create unique passwords for each online account, store them in a secure vault, and automatically fill them the next time you log in to these websites. Many people may not know but some password managers can also store other sensitive personal data like addresses, credit cards, passport information.

“Additionally, with password managers your passwords and sensitive information are synced across all devices, so you can access them from all your mobile devices and laptops, at work or from home."

WHAT AMERICANS WOULD BE WILLING TO PAY TO GET THEIR INFORMATION BACK

• Debit card number $3,968.18

• Email password $3,808.28

• Credit card number $3,498.15

• Amazon password $3,459.79

• Instagram password $3,302.95

• Social security number $3,247.70

• Online banking password $3,212.79

• Healthcare insurance password $2,538.47

• Healthcare records $2,295.38

TOP 5 THINGS PEOPLE WOULD RATHER ENDURE THAN HAVE THEIR INFORMATION STOLEN

1. Do household chores 45%

2. Wait on hold with a customer service agent 43%

3. Sit in traffic 41%

4. Do my taxes 33%

5. Sit in the middle seat on an airplane 32%

TOP 5 WAYS AMERICANS KEEP TRACK OF PASSWORDS

1. Memory 46%

2. My browser saves my passwords 38%

3. Post-it note or written list near my computer 27%

4. Notes on my phone 23%

5. Password management software 21%

TOP 5 THINGS AMERICANS WOULD GIVE UP TO PREVENT HACK

1. Alcohol 35%

2. Reality TV 33%

3. Sports 30%

4. Chocolate 28%

5. Coffee 28%

![]()