By Allison Sadlier // SWNS

New York office - 646-873-7565 / usnews@swns.com

NEWS COPY w/ VIDEO & INFOGRAPHIC

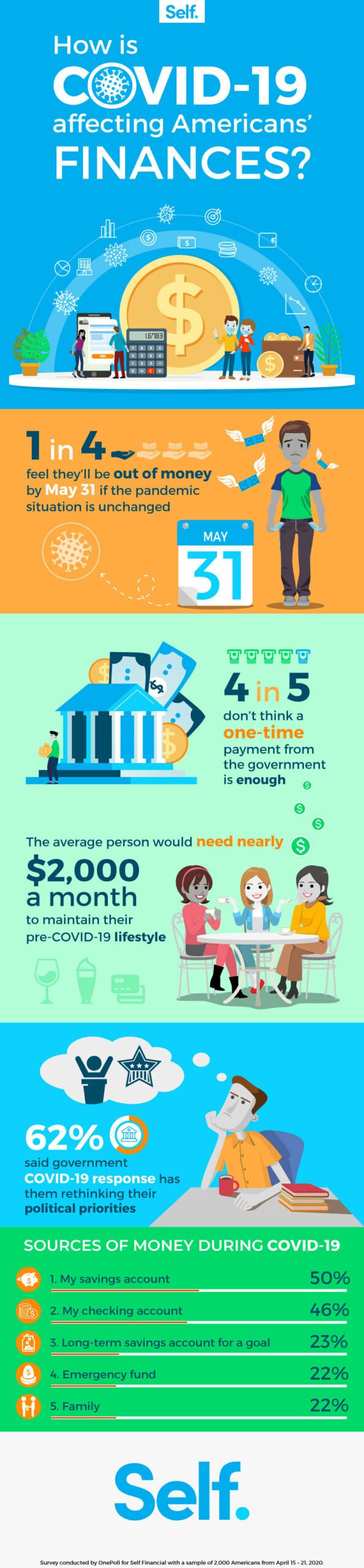

One in four Americans feels they’ll be out of money by May 31 if the COVID-19 isolation continues unchanged, as revealed in a new poll. One in four Americans feels they’ll be out of money by May 31 if the COVID-19 isolation continues unchanged, as revealed in a new poll.

Even with the federal government sending out stimulus checks, four in five (83%) don’t think the one-time payment from the government will be enough to keep them financially afloat during and post-COVID-19. Results found the average person would need $1,912.98 a month to maintain their lifestyle prior to the pandemic and self-isolation orders.

The study of 2,000 Americans examined the financial fallout for people during the pandemic and the far-reaching consequences it will have. Four in five are officially worried about their budgets now and after COVID-19. As far as emotions go, 43% are feeling anxious, while 35% are overwhelmed and 31% are frustrated due to the pandemic.

The survey, commissioned by Self Financial and conducted by OnePoll, revealed people are dipping into different funds in order to make ends meet.

Half of the respondents have taken money from their savings accounts. Nearly one in four (23%) have made sacrifices by taking money from long-term goal accounts for dream items like houses, vacations or special events.One in five have used money from an emergency fund (22%) or received financial assistance from family (22%).

For those who do receive a federal payment, it will quickly go towards necessities like groceries (51%), utilities (44%) and household products (36%). A third will put some of the money into their savings while one in four will use the money to make rent or mortgage payments.

“These results highlight the unfortunately fragile state of many Americans’ finances even where there’s been a high level of employment for quite some time," said a spokesperson for Self Financial. "While the data shows many people are by necessity focused on getting by in the near term, we’re hopeful financial resiliency will increase over the longer term. For now, however, the financial effects of the pandemic won’t make that any easier.”

Respondents’ frustration could have long-lasting effects for the nation as the November election approaches. Sixty-two percent said COVID-19 has caused them to reexamine their political priorities. The COVID-19 response was the second most common election priority among respondents with 50%, second only to health care (58%).

Seven in 10 expressed their frustration with the federal government’s response and actions throughout the pandemic — and the dissatisfaction trickles down. Sixty-three percent admitted they were upset with the response in their own state and 63% were also disappointed in the actions taken by their county officials.

“This situation is forcing many people to make a hard prioritization of expenses where previously they may have had some financial wiggle room," added the Self Financial spokesperson. "How soon they can get back to that flexibility will depend a lot on the recovery of the most profoundly impacted segments of the economy.”

SOURCES OF MONEY DURING COVID-19

- My savings account 50%

- My checking account 46%

- Long-term savings account for a goal 23%

- Emergency fund 22%

- Family 22%

- Retirement fund 20%

- Friends 17%

- Inheritance 15%

- Federal bail-out 15%

- Government unemployment benefits 14%

- Severance pay from a former job 12%

FEDERAL PAYMENT SPENDS

- Groceries 51%

- Utilities 44%

- Household products 36%

- Put it in savings 32%

- Rent/mortgage 27%

- Repairs 18%

![]()