By Zoya Gervis // SWNS

NEWS COPY w/ VIDEO & INFOGRAPHIC

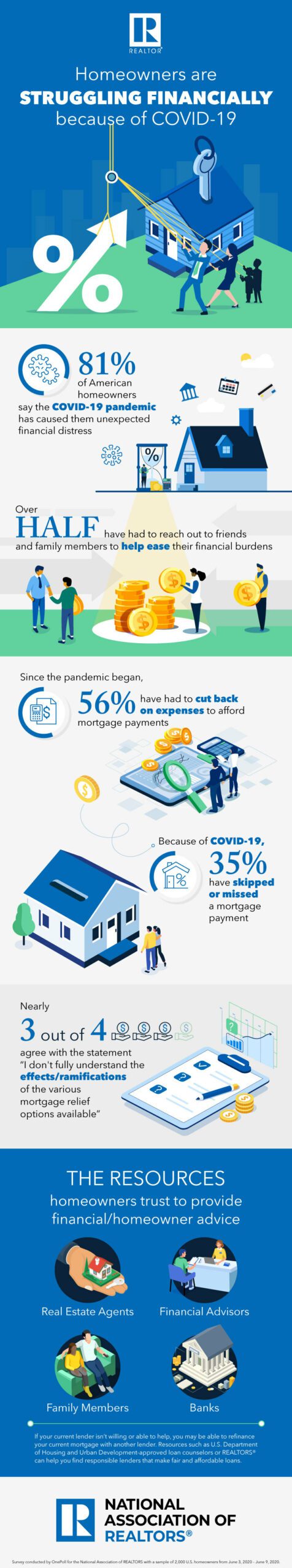

More than half of American homeowners reached out to family or friends for money in order to make mortgage payments and ease their financial burden in the face of the COVID-19 pandemic, according to new research.

The study, which polled 2,000 American homeowners, found 35% of homeowners have skipped or missed a mortgage payment. And the uncertainty that the COVID-19 pandemic has brought is only complicating things for financially insecure homeowners, as 35% have worried about losing their home.

The study conducted by OnePoll in conjunction with the National Association of REALTORS® aimed to uncover the financial struggles of current homeowners and discovered more than 8 out of 10 respondents - 81% - say the COVID-19 pandemic has caused them unexpected financial distress.

Over half (56%) of those surveyed say they’ve had to cut back on their expenses just to afford their mortgage.

Since the pandemic began, nearly half (47%) of homeowners have sought out alternative ways of making money.

In an effort to generate additional income, almost two-thirds of respondents (64%) started a side project while 53% sold personal items.

Given the financial impact of the COVID-19 pandemic, over half (52%) say they are routinely concerned about making their mortgage payments and nearly half (47%) say they’ve considered selling their home because they’re unable to afford the mortgage payments.

“The swift and unprecedented impact of COVID-19 left many people in a financial emergency and we want to make sure struggling homeowners know they have relief options, especially during Homeownership Month,” said National Association of Realtors® President Vince Malta. “Realtors® and lenders can identify programs and aid designed to help meet loan obligations. Acting quickly may help homeowners stay in their homes and keep the money they have already invested into it.”

From clothing (71%) and take-out (66%) to streaming services (46%) and groceries (45%), homeowners have had to significantly cut back on their spending habits.

While mortgage relief options are available, 57% are skeptical about the mortgage relief options that are available to them. Furthermore, nearly 3 out of 4 people feel they don't fully understand the effects or ramifications of the various mortgage relief options available.

And 71% worry they won’t qualify for any mortgage relief options that are out there, with younger homeowners aged 18-23 most likely to agree (83%).

“Unfortunately, at times like these scam activity increases, so homeowners must remain vigilant and watch out for offers that sound too good to be true,” added Malta. “Realtors® work tirelessly to help people achieve their dreams of homeownership and protect their investment. Our members want to do everything possible, including sharing information on available government and financial resources, to make sure homeowners can afford to stay in their homes.”

TOP 5 WAYS HOMEOWNERS HAVE EASED THEIR FINANCIAL BURDEN DURING COVID-19

- Cut down on non-essential expenses 32%

- Asked family members for financial support 31%

- Reached out to friends 22%

- Take on a second job 21%

- Play the lottery 19%

TOP 5 THINGS HOMEOWNERS ARE WORRIED ABOUT AFFORDING DURING COVID-19

- Insurance 43%

- Utilities 36%

- Food 36%

- Cell phone 30%

- Wi-Fi/internet

![]()