By SWNS Staff

NEWS COPY W/ VIDEO & INFOGRAPHIC

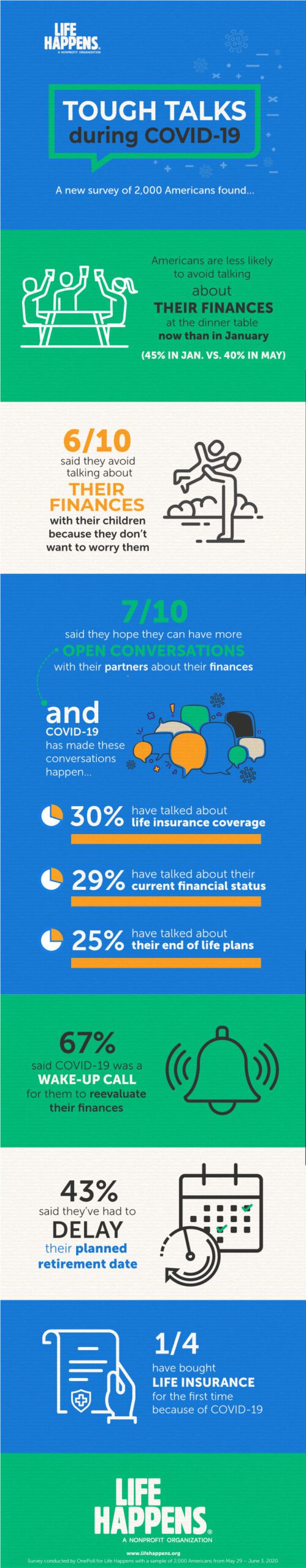

The COVID-19 pandemic has sparked more honest conversations about finances in American households, according to a new study.

The survey asked 2,000 Americans about their finances in light of the coronavirus outbreak and how it has impacted their families’ communication.

Three in 10 respondents shared the pandemic has led them to discuss the important matters of life insurance coverage and their current financial status.

Conducted by OnePoll on behalf of national nonprofit Life Happens, the survey also found that 26% have chatted about future emergency plans as a result COVID-19.

A quarter of respondents also said the coronavirus pandemic has sparked more conversations in their households around their end-of-life plans.

These conversations aren’t easy, as nearly seven in 10 respondents shared that they hope they could have more open conversations with their partners about their finances.

The survey found that the COVID-19 pandemic, however, appears to have made these tough conversations a bit easier to have – or a necessity.

Respondents are less likely to avoid talking about financial matters at the dinner table during quarantine compared to the period before COVID-19, at 40% compared to 45%, in the survey fielded in January 2020.

These conversations seem to be off-limits for their children, however, as 60% of respondents said they avoid talking about their finances with their children because they just don’t want to worry them.

But the coronavirus pandemic may have shown that these conversations are more urgent than ever; 67% of those surveyed said this crisis has been a wake-up call for them to reevaluate their finances.

Forty-three percent of respondents also shared they’ve reevaluated their retirement and now plan to keep working and delay their planned retirement date.

Another 37% of those surveyed shared they’ve even dipped into their retirement to cover unexpected costs they’ve encountered throughout the course of the pandemic.

And despite feeling financially strained themselves, 38% of respondents said they’re financially supporting someone else as a result of the crisis.

Respondents shared that they believe it will take 8.5 months for them to feel comfortable in their financial status again due to the impacts of COVID-19.

“Millions of Americans have been impacted financially by COVID-19, with the pandemic serving as an unfortunate reminder that financial preparedness and security can be a lifeline during these uncertain times,” said Faisa Stafford, president and CEO of Life Happens. “What’s clear from this study is that people are more willing to have those uncomfortable yet critical conversations about finances and life insurance – and in turn, take positive financial action, too.”

The survey also asked respondents how they plan to stabilize their finances and found nearly half of those surveyed said they plan to cut excess spending and another 45% shared they plan to build up their emergency funds.

A quarter of respondents even said they’ve bought life insurance for the first time because of the pandemic.

“Our study showed that 66% of people agree that COVID-19 has made them better understand the value of life insurance, and the time to act is now,” said Faisa Stafford. “We can come away from this situation with important lessons. One lesson should be that life insurance is not an option, but a necessity – providing you with peace of mind and your loved ones with a crucial financial protection if the unexpected happens.”

To help Americans reassess their financial preparedness, Life Happens has free resources and tools, including Life Happens’ Life Insurance Needs Calculator to help evaluate your own life insurance needs.

TOP FINANCIAL CHANGES DUE TO COVID

- Cut excess spending - 49%

- Continue working and delay their planned retirement date - 43%

- Build up savings and emergency funds - 45%

- Focus on paying down debts - 24%

TOP TOPICS DISCUSSED WITH PARTNER/FAMILY DURING COVID-19

- Wills and inheritance - 33%

- Current health issues and concerns - 32%

- Life insurance coverage - 30%

- Current financial status - 29%

- Emergency savings - 27%

- Future emergency plans - 26%

- Politics - 25%

- End of life plans - 25%

- Delaying plans to retire - 21%

- Moving or selling a home - 17%

![]()