By SWNS Staff

NEWS COPY w/ VIDEO + INFOGRAPHIC

Growing their own vegetables, switching to one-ply toilet paper, and eating lots of leftovers…these are just a few ways Americans are pinching pennies during the COVID-19 pandemic, according to new research.

Interestingly, over half of Americans polled credit the COVID-19 pandemic with finally teaching them how to be smart with their money.

A similar study from two years ago showed this number is in fact up. In 2018, only 42% felt very smart with money; in 2020, that number jumped to 51%.

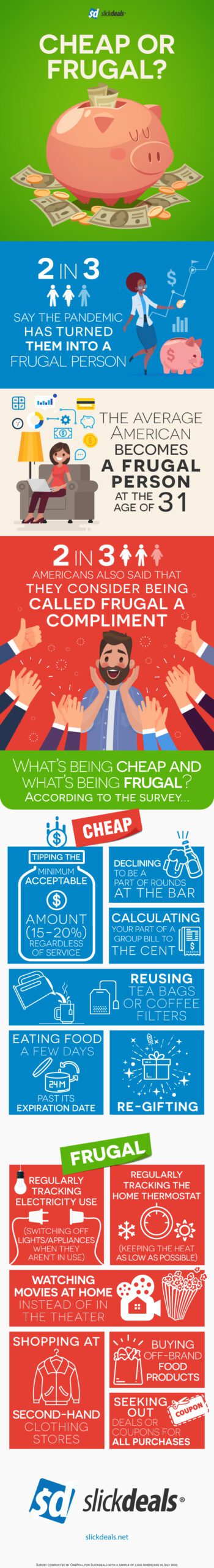

Another two in three say the pandemic has turned them into a frugal person.

The polls of 2,000 Americans, both conducted by OnePoll on behalf of Slickdeals, looked into how the pandemic changed Americans’ mindsets about their money and how they define being “cheap” vs. being “frugal.”

The study is meant to mirror one they ran in 2018 to see just how much the results have changed after two years and a global pandemic.

Tipping the minimum (15%-20%) regardless of service was found to be “cheap.” Interestingly, in 2018, skimping on the tip was voted to be an act of frugality.

Declining to be part of rounds at the bar was considered cheap by respondents, as was calculating your share of the group bill down to the cent.

Other cheap actions? Still using very outdated electronics, re-gifting, and diluting soap containers with water.

Clothes shopping at a secondhand store, however? That’s just being “frugal.” And so is buying off-brand food products, buying no-name electronics, and always seeking out deals or coupons when going shopping.

Also considered frugal was tracking your electricity and heating usage at home to keep the utility bills down.

According to the survey, the average American becomes a frugal person at the age of 31, with one in four saying it happened even earlier for them.

Two in three Americans also said that they consider being called frugal a compliment.

“The coronavirus pandemic has tragically impacted the financial situations of many people, and brought new focus to the importance of prioritizing spending,” said Josh Meyers, CEO of Slickdeals. “We see a shift toward smarter spending with 65 percent of respondents indicating that the pandemic has transformed them into a frugal person, and 67 percent reporting that being called frugal is actually a compliment.”

Your financial mindset can also be impactful when on the dating scene.

Two-thirds of those polled said they actually think using a coupon on a first date is completely acceptable.

In fact, 45% said they’d happily use a coupon on a first date.

Three in four say that the more they age, the more desirable it is for a romantic prospect having a smart financial mindset.

Added Meyers, “Being frugal encompasses money, convenience and time, coupled with value. At Slickdeals, we equate frugality with smart shopping and we’ve assembled the largest community of savvy consumers so users can score the best deals on the best products, with insight from millions of real people.”

CHEAP OR FRUGAL?

| CHEAP | FRUGAL |

| Tipping the minimum acceptable amount (15-20%) regardless of service | Regularly tracking electricity use (switching off lights/appliances when they aren't in use) |

| Declining to be a part of rounds at the bar | Regularly tracking the home thermostat (keeping the heat as low as possible) |

| Calculating your part of a group bill to the cent | Watching movies at home instead of in the theater |

| Keeping outdated or worn out electronics, as long as they still barely work | Shopping at second-hand clothing stores |

| Reusing tea bags or coffee filters | Buying clothes at department stores like Kmart, Walmart etc |

| Eating food a few days past its expiration date | Buying off-brand food products |

| Lengthening longevity of soap by diluting soap bottles with water | Buying no-name electronics (such as ear buds from the corner stone) |

| Re-gifting | Giving up drinking while at bars or restaurants / Only having alcohol at home |

| Seeking out deals or coupons for all purchases |

![]()