By SWNS Staff

NEWS COPY W/ VIDEO + INFOGRAPHIC

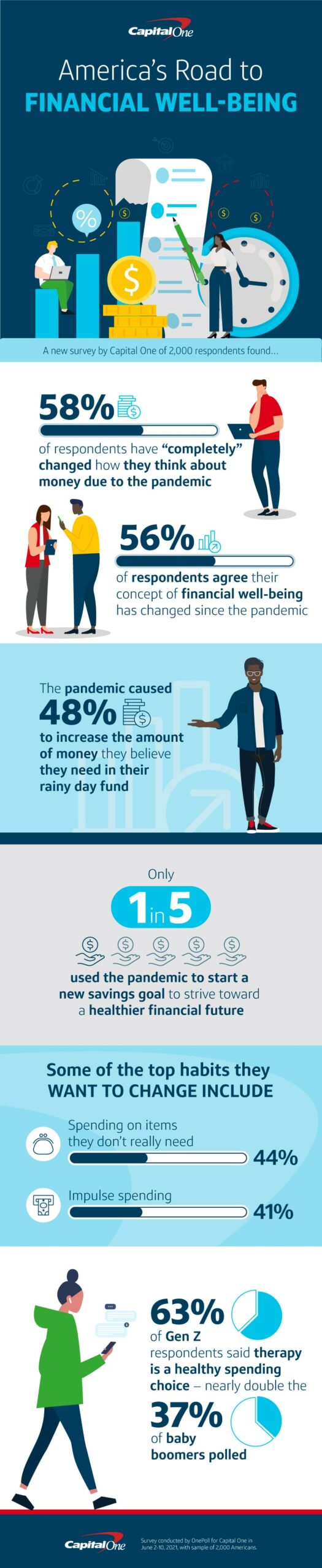

If you’ve taken a step back to review your finances during the pandemic, you’re certainly not alone. A new survey revealed 58% of Americans have “completely” changed how they think about money due to the pandemic and nearly as many (56%) believe their concept of financial well-being has been altered since the pandemic.

The study of 2,000 Americans explored the impact financial wellness has on their mental and physical health.

In fact, the pandemic caused 48% to increase the amount of money they believe they need in their rainy day or emergency fund.

Conducted by OnePoll on behalf of Capital One, the survey found respondents added one month of emergency expenses to their savings (an average of five months pre-pandemic to six months now).

Three in 10 respondents said their top financial struggle is establishing good spending habits, so it’s no wonder the top habit they want to change is spending on items they don’t really need (44%).

Impulse spending is another habit two in five respondents are trying to shake, and 41% even said they made impulse purchases during the pandemic they regretted.

Twenty-nine percent of these respondents blamed pandemic-related stress for their impulse spends – which cost an average of $162 per spend.

And while men were less likely to make impulse purchases than women, they were often more expensive with more than one in 4 (27%) spending over $250 on their impulse purchase.

"After living through the last year and a half, one of the most important things we’ve learned is that there isn’t a ‘one-size-fits-all’ approach to well-being,” said Lia Dean, President, Retail Bank & Premium Card Products, Capital One. “People have always been stressed about money, perhaps never more so than right now, which is why we want to create a world where our customers can save more and live fully without losing sleep over their finances."

Nearly three in 10 (29%) respondents believe their credit score is the strongest indicator of their financial well-being, followed by the ability to pursue their financial goals without concern (19%).

One in five respondents used the pandemic to start a new savings goal as they strive toward a healthier financial future.

As they look ahead over the next year, some of Americans’ top goals included starting an emergency fund (39%), paying off their credit card (34%) and starting to save for retirement (24%).

With all of these financial firsts and new goals in mind, 33% of those surveyed are confident they could actually become a “finfluencer” to advise their family and friends on financial decision-making.

TOP PANDEMIC FINANCIAL FIRSTS

- Made a new savings goal - 20%

- Prioritize my mental health with therapy, meditation or another ritual - 19%

- Started a side hustle - 18%

- Started exercising regularly - 17%

- Investing in stock - 12%

- Started an emergency fund - 12%

- Applied for a credit card - 11%

- Investing in cryptocurrency - 11%

- Started a 401k - 5%

- Applied for a mortgage - 4%

- Began consulting with a financial coach - 3%

TOP GOALS FOR NEXT 12 MONTHS

- Start an emergency fund - 39%

- Pay off my credit card - 34%

- Save up for a big vacation - 29%

- Start saving for retirement - 24%

- Pay off student loans - 15%

- Pay off my mortgage - 9%

![]()