By Zoya Gervis // SWNS

NEWS COPY w/ VIDEO + INFOGRAPHIC

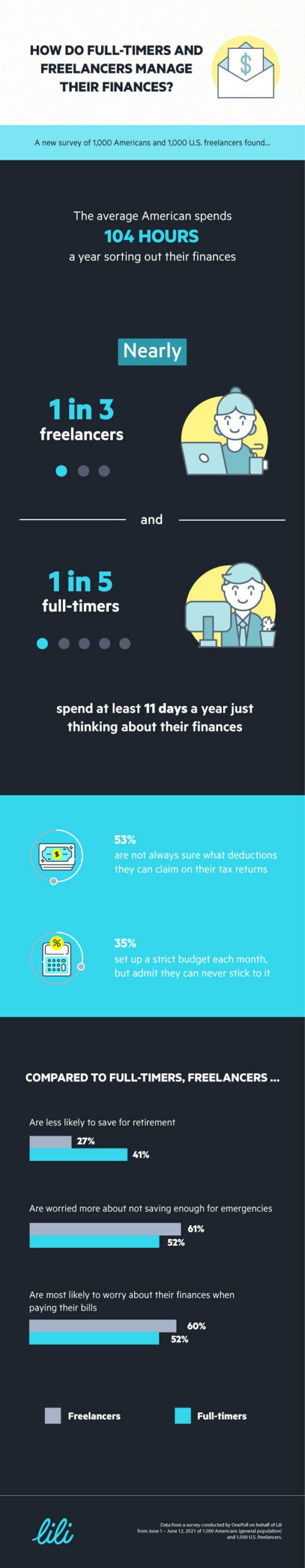

A summer of quitting and the pandemic economy have brought about a freelance boom, but more money also means more problems. The average American spends 104 hours a year sorting out their finances — including organizing expenses, paying bills and checking their account balance, new research suggests.

A new survey of 2,000 Americans, half of whom are freelancers, revealed that nearly one in three freelancers and one in five full-time employees spend at least 11 days a year just thinking about their finances.

Those similarities may signal the end of the freelance stigma, but while freelancers and full-timers both spend similar amounts of time on their finances, freelancers are less likely to save for retirement (27% vs 41%) and are worried more about not saving enough for emergencies (61% vs 52%).

And 60% of freelancers are most likely to worry about their finances when paying their bills, versus 52% of full-time workers.

The survey, conducted by OnePoll in collaboration with Lili, also looked at the ways in which Americans manage — and mismanage — their hard-earned dollars.

While 35% make an effort to manage their money by setting up a strict budget each month, they admit they can never stick to it.

The reason? Bad money habits, such as overspending, impulse purchases, buying things that aren’t really needed, spending too much on gifts and buying fast food and soda.

One person even admitted to “spending so much on in-app purchases, it’s insane.”

It’s safe to say Americans are crying out for a financial Marie Kondo to intervene in their lives — nearly one in three said their finances are the least organized area of their life.

And being financially savvy in the present can affect people’s plans for the future — a concern for freelancers and full-timers alike.

While more than half (53%) are most worried about not having enough saved if something happens, only 17% actually have an emergency fund.

Taxes, too, can be a financial blind spot — 53% are not always sure what deductions they can claim on their tax returns.

That may be why two in five said they experience extreme anxiety when doing their taxes, and 44% worry about not claiming things properly on their taxes.

“Taxes and expense management can be more complicated for freelancers, who also tend to juggle between their work and personal finances,” said a spokesperson for Lili. “These needs are often unmet, so there’s a real necessity for creating financial solutions designed for the freelancer community.”

When asked what they want to spend more money on, 43% of respondents named vacations at the top of their list, but the rest of the items were mainly essentials, such as clothing (34%), food (33%) and home/apartment repairs (30%).

While their current relationship with their finances may be “complicated,” more than half (53%) wish they got along better with their money.

“With freelancers becoming a growing force in the U.S. economy, it’s clear they are also seeking ways to save toward taxes and set aside for emergencies, among other things,” the spokesperson added. “We’re proud to support those not working a traditional nine to five with solutions to help manage their finances.

AMERICANS’ WORST MONEY HABITS

- Spending too much on gifts

- Buying things they don’t really need

- Writing a list of things I need and then not following it

- Being unable to say no to my children when they ask for something

- Loaning other people money when I don't have enough saved for my own retirement

- “Spending so much on in-app purchases, it’s insane”

- “I have a really bad habit of seeing a neat toy or cute clothes for my grandkids and buying them”

- Spending money on fast food and soda

- Gambling

- Overspending

- Not having an emergency fund

Sorting out finances

2 hours a week x 52 weeks = 104 hours a year (more than 4 days)

Thinking about finances

5 hours a week x 52 weeks = 260 hours (11 days)

![]()