By Zoya Gervis // SWNS

NEWS COPY W/ VIDEO + INFOGRAPHIC

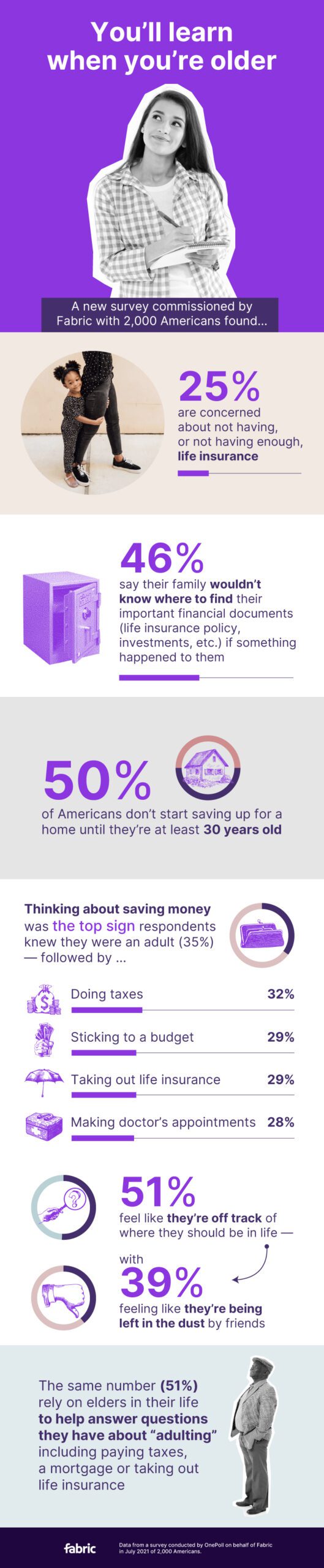

Half of Americans don’t start saving up for a home until they’re at least 30 years old, according to new research.

A survey polled 2,000 Americans about all the parts of life that make them feel old and found that the top sign they knew they were an adult was when they finally had to think about saving money (35%).

Other top “adulting” signs were doing their taxes (32%), signing up for life insurance (29%) and sticking to a budget (29%).

Nearly three in five (58%) were afraid of taking on “adulting” tasks before living on their own, and a similar amount wish they were better prepared to take on the responsibilities (56%).

Conducted by OnePoll and commissioned by Fabric, the survey showed that more than half of Americans (51%) feel like they’re off track of where they should be in life, in general — with 39% feeling like they’re being left in the dust by friends.

On average, people think others should start feeling like an adult at age 25, although 30% didn’t start feeling like an adult until after that.

People start getting excited about small adult life joys like buying a vacuum or organizing their cabinets at around 22 years old.

Still, half of Americans (51%) rely on elders in their life to help answer questions they have about “adulting” including paying taxes, a mortgage or taking out life insurance.

Some of the biggest concerns that people have about becoming an adult revolve around not having enough money in their personal savings (41%), for retirement (35%) and for health and medical expenses (30%).

Parents who took the survey of course have their kids on their mind; 35% of parents worry about not having enough money saved for their children.

Becoming a parent has also made 43% more careful drivers, 31% more concerned about nutrition labels and 30% more interested in applying for life insurance.

On average, the study found that people think they will be the most concerned about their health around age 35.

Although half of Americans say they have open conversations about their finances with their families, 46% say that their family wouldn’t know where to find their important financial documents if something happened to them.

But in the event that something was to happen to them, more than two in three Americans have life insurance that their loved ones can fall back on.

However, results showed that people would rather clean the toilet (32%), comfort a crying baby (30%), or watch paint dry (25%) instead of looking into life insurance.

“Tackling important adult to-dos like finding the right life insurance policy for you and your family can be difficult and overwhelming. In fact, many people don’t even know where to begin. The good news is that in today’s digital world, it’s simpler than you think. Convenient and easy-to-understand digital solutions can make these often-cumbersome tasks a lot easier,” stated Adam Erlebacher, Co-Founder and CEO of Fabric.

Nearly two in five (38%) have given up on trying to get life insurance, usually after receiving two quotes, because of the confusing jargon and policy options.

Almost half of Americans (48%) are thinking about life insurance more than ever after the pandemic, though a similar amount (50%) are still not confident in their understanding of how life insurance costs are determined.

TOP FINANCE CONCERNS

- Not having enough money in personal savings (41%)

- Not having enough money for retirement (35%)

- Health and medical expenses (30%)

- Not having, or not having enough, life insurance (25%)

- Not enough emergency funds (24%)

ENDS