By SWNS Staff // SWNS

NEWS COPY w/ VIDEO + INFOGRAPHIC

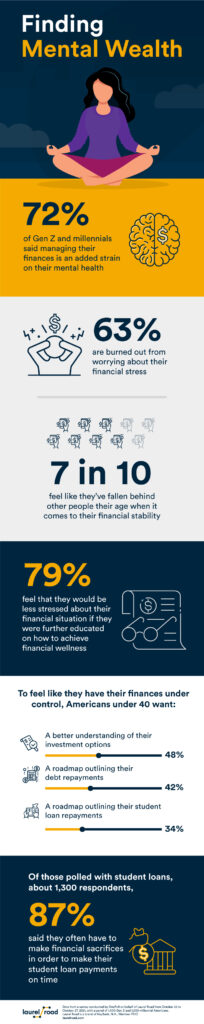

Nearly three in four Americans under 40 say managing their finances is a strain on their mental health, according to new research.

A new survey asked 2,000 Gen Z and millennial Americans about their finances and found financial stress truly comes in all shapes and sizes – but usually checking their accounts is what sets them off.

In fact, almost two-thirds (65%) of respondents are often anxious to check their bank account and three-quarters (75%) feel the same when it comes to checking on their pending charges from the weekend. Seven in 10 also shudder at the thought of checking their credit card statement.

Conducted by OnePoll on behalf of Laurel Road, a digital banking platform, the survey found financial stress may come with age, as 74% of millennial respondents are worried that they’re falling behind on their goals for their financial future compared to 65% of Gen Z respondents.

Seventy percent of all respondents also feel like they’ve fallen way behind other people their age when it comes to their financial stability and 62% said they’re “constantly” stressed when it comes to money.

The good news is Gen Z and millennials are taking steps to alleviate these stressors, as 65% said talking to others about their financial situation helps reduce their stress levels. Additionally, they know what’s needed to help them on their financial journey, as 76% feel they’d be less stressed if they had more control over the finances, such as having a financial plan in place.

Notably, nearly four in five (79%) also shared they’d feel more confident in their financial situation if they were further educated on how they can achieve financial wellness. Plus, Gen-Z and millennials, on average, said they would need nearly $3,000 in savings to alleviate financial stress.

To that end, this group is also changing their approach to personal finance given the pandemic shifted their goals and created new concerns, as they are continuing to focus on saving more each month (44%), setting aside their pandemic savings for the future (36%) and gearing up to pay off more of their student loans (32%).

“Financial stress and anxiety are incredibly common feelings among Gen Z and millennials, many of whom are facing new challenges in light of the pandemic, and we’re seeing firsthand that this group is interested in taking the steps needed to alleviate stressors and strengthen their finances and mental health,” said Alyssa Schaefer, General Manager & Chief Experience Officer at Laurel Road. “Importantly, we see that cultivating ‘mental wealth’ is clearly a priority for many individuals as they continue to focus on increasing their savings, creating a financial plan and building financial wellness — all of which will help to get them there.”

The survey also asked respondents about the role their student loans play in their financial stress and mental health. Of those polled with student loans (approximately 1,300 respondents), 87% said they often have to make financial sacrifices in order to make their student loan payments on time.

When it comes to student loans and mental health, one in five respondents with federal student loans (just over 700 respondents) said they’re feeling anxious about the federal forbearance period ending in January. However, over three-quarters (77%) do feel prepared to start making their payments again. This is significantly higher among millennials, where 84% feel confident compared to 71% of Gen Z respondents.

“As the student loan forbearance period ending fast approaches, it’s important that Gen Z and millennials know what options are available to them to retain and build their future savings,” Schaefer added. “There are many options available to chip away at debt by making small monthly payments or refinancing student loans to secure a lower interest rate. These choices will ultimately provide more financial freedom to navigate stress and allow for additional money to be spent on supporting self-care or achieving larger savings goals.”

Overall, Gen Z and millennials are looking for ways to get their finances under control, with respondents saying a better understanding of investment options (48%), roadmaps outlining debt repayments (41%) and a student loan repayment plan (34%) would all help them.

THE TOP FINANCIAL STRESSORS FOR AMERICANS UNDER 40

- Paying monthly bills (28%)

- Trying not to overspend (27%)

- Saving for a home (27%)

- Making a monthly budget and sticking to it (26%)

- Putting money into a savings account (26%)

- Saving for retirement (26%)

- Learning about investing (26%)

- Talking about finances with their spouse/partner (25%)

- Doing their taxes (25%)

- Understanding their current financial state (24%)

- Overspending on their credit card (24%)

- Monitoring their credit score (23%)

- Paying rent on time (23%)

- Putting money in their 401K (23%)

- Saving money for their kids (23%)

- Making mortgage payments (22%)

- Student loan payments (18%)