By SWNS Staff

NEWS COPY w/ VIDEO + INFOGRAPHIC

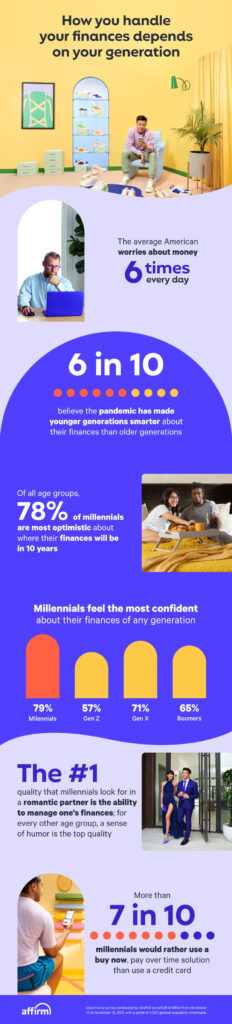

The average American worries about money six times a day, according to new research.

The study polled 2,000 Americans, split evenly by generation, to uncover how Americans feel about their finances and found millennials are more focused on money than any other generation, but they’re also worrying about money the most – an average of seven times a day.

Overall, respondents agreed millennials (30%) and Gen Z (22%) are better at managing their finances than their Gen X (14%) and boomer (18%) counterparts. Additionally, millennials were the most optimistic (78%) about where their finances will be in 10 years and boomers were the least optimistic (57%).

Of all generations, millennials feel the most confident about their finances (79%), followed by boomers (65%) and Gen X (71%). Gen Z were the least confident in their financial skills (57%).

Commissioned by Affirm and conducted by OnePoll, the study revealed six in 10 of all respondents agree that living through the pandemic has made younger generations smarter about their finances than their older counterparts.

Case in point, Gen Z respondents seem to start investing in their savings earlier than any other generation. The results found 42% of Gen Z started saving or plan to start saving by age 25, compared to 28% of millennials, 24% of Gen X and 17% of boomers.

The survey also took a look at financial anxieties and the biggest hurdles each generation faces when it comes to finances. With money as top source of anxiety for many Americans, the survey revealed (43%) of respondents would give up drinking alcohol for five years to retire today, while three in 10 would give up sex (30%) or their friends (29%).

Respondents are thinking about money as it relates to their romantic lives, as well. Over half (51%) of millennials surveyed said the ability to manage one’s finances is the top thing they look for in a partner, compared to a sense of humor for Gen Z, Gen X and baby boomers.

When looking for a romantic partner, all respondents agreed a partner’s ability to manage their finances (45%) and their financial stability (45%) are more important than their physical appearance (39%). Furthermore, of those actively in the market looking for a partner, 68% said they’d go so far as to break up with someone if they managed their finances poorly.

Overspending is also a top concern across generations – more than half (56%) of respondents said they often overextend their spending and are left in difficult financial positions. The #1 habit that harms respondents' budgets is falling to impulse purchases (41%), followed by ordering takeout (38%), going out with friends (34%) and getting hit with late fees (34%).

“With 40% of millennials agreeing credit card debt is their biggest financial setback, it’s no surprise that we’re seeing this group embrace more modern, flexible payment options,” said Silvija Martincevic, Chief Commercial Officer at Affirm. “Over half (56%) of all respondents are interested in using a buy now, pay later solution in 2022 and nearly three quarters (72%) of millennials agreed they’d rather use one than a credit card.”

As respondents navigate the urge to overspend, the survey found Americans are relying on pay-over-time solutions to stay in budget when shopping. Nearly half (49%) of respondents (and 68% of millennials, specifically) won’t complete a purchase if a store does not offer a pay-over-time option at checkout.