By Joseph Staples // SWNS

NEWS COPY W/ VIDEO + INFOGRAPHIC

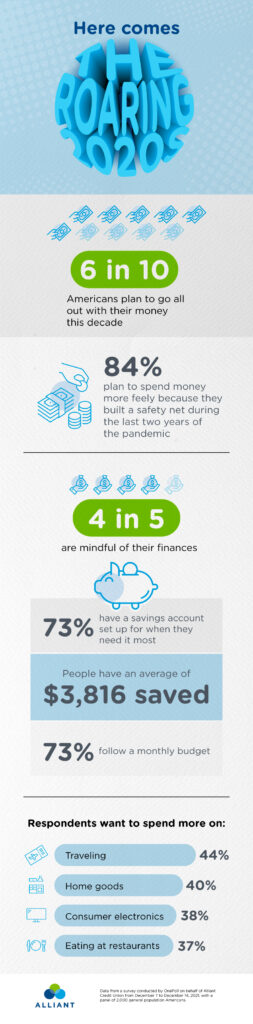

The “Roaring 2020s” are just around the corner: six in 10 Americans plan to go all out in the coming years by enjoying what they missed out on in the last few years.

A survey of 2,000 adults found 70% are looking to have more fun with their finances over the next decade, with 84% stating their plans to spend more freely are due to having built a financial safety net during the pandemic.

Fifty-nine percent of Gen Zers (ages 18 to 24) are more likely to enjoy their money in the coming years, compared to 45% of millennials (ages 25 to 40) and 25% of Gen Xers (41 to 56).

On the other hand, 36% of boomers (57+) plan on enjoying their money while also sticking to a very tight budget.

And when it comes to emergency funds, close to three-quarters (73%) have a savings account set up for when they need it most — with an average of $3,816.

Commissioned by Alliant Credit Union and conducted by OnePoll, the study revealed 77% of millennials had rethought their budget since the pandemic began, above the 72% average set by all generations.

A third of those polled (31%) prefer spending money on experiences, and a quarter (25%) on material things. Thirty-five percent believe in spending money on both types equally.

Over the next decade, respondents want to spend more money on traveling (44%), home goods (40%), consumer electronics (38%), eating at restaurants (37%) and groceries (37%).

"The last couple of years have helped us all realize what we value most. Saving for retirement and a rainy day is incredibly important but so is spending money on the things that bring you joy each day,” said Chris Moore, director of deposits and payment product strategy at Alliant Credit Union. “As long as you realistically budget for it, you can truly enjoy spending money on that next vacation or new gadget."

Still, a majority believe that with great fun comes great responsibility. Four in five Americans are careful with their finances, with 73% of people regularly following a monthly budget for all their financial needs.

Out of all generations, Gen Xers are the most cautious with their finances (87%), compared to seniors over 76 (84%), boomers (83%), millennials (78%) and Gen-Z (76%).

Half of the funds in people’s budget goes to rent/mortgages (26%) and groceries (23%). Meanwhile, 18% regularly goes to recurring bills, 17% to utilities and 17% to recreational activities and fun.

Gen Z Americans especially feel the budget burn: two-thirds of their budget (68%) is spent on rent alone.

Forty-six percent of Gen-Z Americans have multiple savings and checking accounts to help them budget. Respondents are also likely to use spreadsheets (45%) and budgeting apps (38%) to help them stay on top of purchases.

"Every successful budget needs a ‘fun’ spending category,” added Moore. “The key is to set realistic savings goals and budget accordingly so you know exactly how much you can spend on the things you love. It's OK to adjust your budget each month to spend on the experiences you have missed during the pandemic."

WHAT WILL MONEY BE SPENT ON IN THE ROARING 2020s?

- Traveling 44%

- Home goods/decor 40%

- Consumer electronics 38%

- Restaurants 37%

- Groceries 37%

- Clothing 37%

- Live entertainment 37%

- Shoes 29%

- Museum exhibits 27%