By Aleksandra Vayntraub

NEWS COPY w/ VIDEO + INFOGRAPHIC

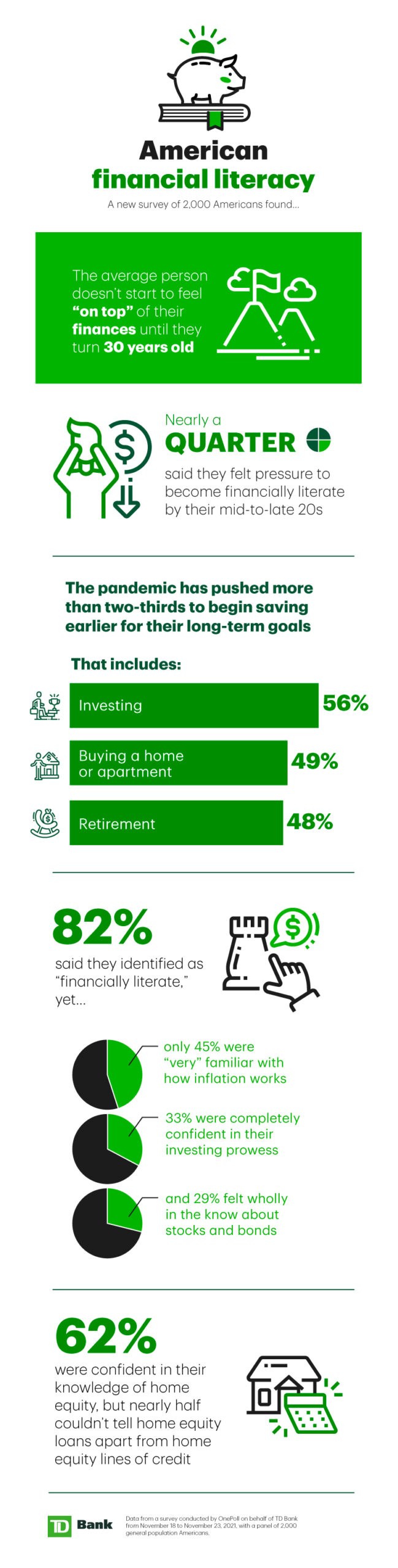

The average American doesn’t start to feel “on top” of their finances until they turn 30 years old, new research suggests.

In a recent survey of 2,000 U.S. respondents, nearly a quarter of respondents said they felt pressure to become financially literate by their mid-to-late 20s.

The survey also found that 82% of those polled said they identified as “financially literate.”

But despite their confidence, the average respondent could only correctly answer half of the questions in a quiz from the Financial Industry Regulatory Authority, a government-authorized not-for-profit organization that works to regulate the broker-dealer industry.

Conducted by OnePoll on behalf of TD Bank, results revealed various knowledge gaps in people’s financial literacy. Only 45% were “very” familiar with how inflation works, while 33% were completely confident in their investing prowess and 29% felt wholly in the know about stocks and bonds.

The pandemic has pushed more than two-thirds to begin saving for their long-term goals earlier than they previously planned. Their No. 1 goal? Investing (56%), followed by more specific aims such as buying a home or apartment (49%) and retirement (48%).

Millennials in particular have become more curious about investing, with more than half considering or already purchasing cryptocurrency and commodities such as gold or silver.

When presented with a list of example loans, most were familiar with mortgages (43%) and auto loans (40%), much more than with a small business loan (30%) or a cash advance (27%).

And although 62% were confident in their knowledge of home equity, nearly half couldn’t tell home equity loans apart from home equity lines of credit.

Another 33% were unaware that a rising federal funds rate can make either one of these loans more costly.

“Although many have begun planning earlier for their long-term goals, they’re not always aware of the different tools they may already have to do so,” said Michael Innis-Thompson, Head of Community Lending & Development. “For example, homeowners can use home equity, or the difference between their mortgage and what their home is currently worth, to make renovations through a home equity loan or line of credit. You don’t necessarily have to own your home for several years before tapping into home equity; every situation is different, but having good credit, a reliable income and 15% to 20% equity can sometimes be enough to qualify.”

Eight in 10 homeowners said they know “exactly” or “approximately” how much equity is in their home, indicating the pandemic housing boom may have encouraged them to learn what their homes are worth, even if they may not be financially literate in other areas.

“There are many paths to becoming more financially literate,” Innis-Thompson added. “Whether you want to put money aside for retirement, learn how to invest, or better understand the equity and value in your home, the important thing to know is that there are free tools and resources to help you achieve your personal goals and financial stability.”