By Vanessa Mangru-Kumar // SWNS

NEWS COPY W/ VIDEO + INFOGRAPHIC

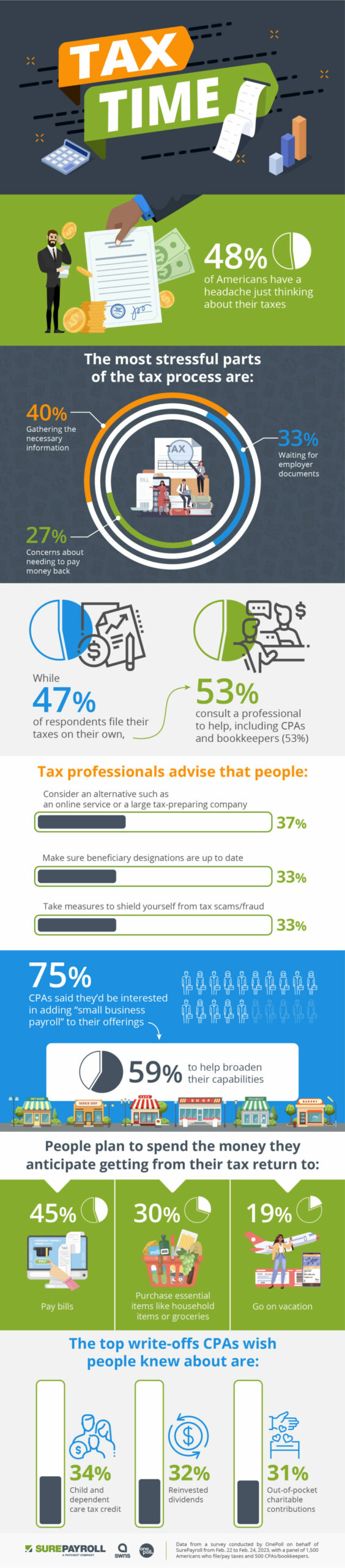

Nearly half of Americans have a headache just thinking about their taxes (48%), according to new research.

A survey of 2,000 U.S. adults, 500 of them CPAs and bookkeepers, looked at some of the pain points around tax season.

Most respondents start filing their taxes in February (39%) or March (28%), but the average tax professional estimates that 41% of people file their personal taxes too late, with one in six recommending that people start filing as early as January.

Conducted by OnePoll for SurePayroll, the survey found that across the board, the most stressful parts of the tax process are gathering the necessary information (40%), waiting for employer documents (33%) and concerns about needing to pay money back (27%).

“Starting tax prep well before April pays big returns for small business owners when it comes to reducing stress,” said Marcus O’Malley, SurePayroll CPA/reseller product lead. “Half of CPAs recommend that small business owners receive professional assistance with their taxes. And 79% have referred their clients to an online payroll service, a move that centralizes important tax prep documents and saves small business owners time and stress.”

While 47% of all respondents file their taxes on their own, 53% consult a professional to help, including CPAs and bookkeepers (53%).

Tax professionals consult others in their field when they need help maximizing their return (63%) or are looking for financial advice (62%). However, 73% admit that they’d be concerned with finding a professional who maximizes their return.

They understand that time is money since the average CPA/bookkeeper would spend $1,900 for another professional to help meet their tax needs, and 43% would spend upwards of $2,000.

For the average respondent who may have less extensive tax needs, people would spend just under $500 for professional help.

CPAs and bookkeepers advise that professional tax help is necessary when someone makes a certain income (53%) and 44% said anyone who has any kind of paid job should seek a tax preparer’s opinion.

Other pieces of advice they’d give to those filing taxes are to consider an alternative such as an online service or a large tax-preparing company (37%), make sure beneficiary designations are up to date (33%) and to take measures to shield yourself from tax scams/fraud (33%).

Following some of this advice may help tax professionals in the long run who said the most stressful parts of their job are reviewing updates on tax codes (62%) and rectifying errors in estimates or client misinformation (58%).

Being informed is an important first step, as just 30% of non-CPAs/bookkeepers knew when Tax Day was (April 18). However, more than a quarter of professionals also misidentified Tax Day this year (28%).

According to CPAs, 1-2 weeks leading up to the deadline is the most stressful period of tax season (35%). And although the average professional worked on just 30 individual returns last season, one in eight rate their work-life balance as “fair” or “poor.”

Still, CPAs said they’d be interested in adding “small business payroll” to their offerings (75%) to help broaden their capabilities (59%).

“Even with just 24% of CPAs rating their work-life balance as excellent, a significant number (84%) are willing to teach a course to clients about basic tax information as a way to help small businesses in the community,” said O’Malley.“

As for plans for their return, more than a quarter of all those surveyed said they’ve already spent money they’re expecting to get back this year (28%).

Others plan to spend the money they anticipate getting to pay off bills (45%), purchase essential items like household items or groceries (30%) or go on vacation (19%).

However, some respondents may need a backup plan since one in eight have owed money at least five times in the past instead of getting any back.

More than half of those surveyed said they wouldn’t be able to afford to owe a significant amount of money back for taxes this year (53%).

LEAST-KNOWN TAX WRITE-OFFS CPAS WISH CLIENTS KNEW

- Child and dependent care tax credit — 34%

- Reinvested dividends — 32%

- Out-of-pocket charitable contributions — 31%

- Lifetime Learning credit — 31%

- Earned income tax credit (EITC) — 28% [TIED]

- Deduction of Medicare premiums for the self-employed — 28% [TIED]

- Student loan interest paid by you or someone else — 28%

- State sales tax — 23%

- American Opportunity credit — 19%

- State tax you paid last spring — 18%

Survey methodology:

This random double-opt-in survey of 1,500 Americans who file taxes and 500 CPAs/bookkeepers was commissioned by SurePayroll between Feb. 22. and Feb. 24, 2023. It was conducted by market research company OnePoll, whose team members are members of the Market Research Society and have corporate membership to the American Association for Public Opinion Research (AAPOR) and the European Society for Opinion and Marketing Research (ESOMAR).