By Joseph Staples // SWNS

NEWS COPY W/ VIDEO + INFOGRAPHIC

Enough talk about millennials and their avocado-toast-buying ways — new data suggests every generation is at risk of spending too much cash on their grub.

A poll of 1,800 US adults found, across the board, 48% said their grocery costs are eating up the majority of their monthly budget, followed by utility bills (38%) and credit card debt (37%).

Younger Americans seem to be focused on their financial positioning for the future, as well. Thirty-eight percent Gen Zers are delegating the majority of their monthly budget towards loans, while 46% of millennials are likewise spending most of their money tackling credit card debt.

Meanwhile, 45% of Gen X is spending the most on groceries, 43% of baby boomers are paying the most on utility bills and 43% of the Silent generation are forking up the most for their rent and/or mortgages.

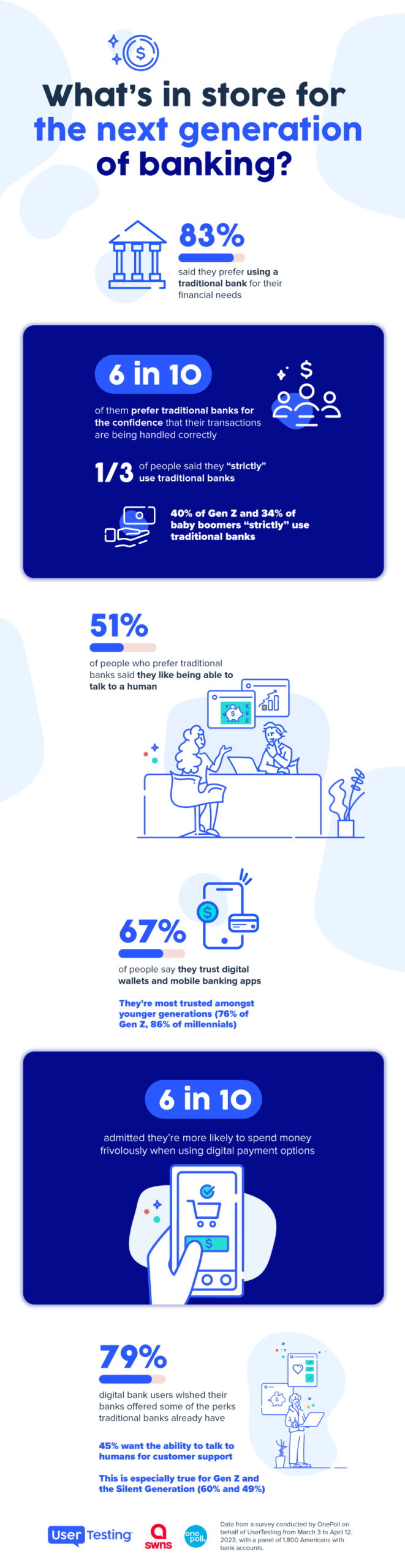

Commissioned by UserTesting and conducted by OnePoll, the study also revealed that when it comes to finances and banking, people across all generations prefer a human touch — 83% said they prefer using a traditional bank for their financial needs.

A third of people (36%) said they “strictly” use traditional banks, ditching digital completely — including 40% of Gen Z and 34% of baby boomers. In comparison, only 10% overall said they rather just use a digital bank with no physical presence.

People who prefer traditional banks said they like having the confidence their transactions are being handled correctly (60%) and being able to talk to a human (51%).

We’re seeing a strange dichotomy in banking unfolding in front of us,” said Dana Bishop, VP of Experience Research Strategy at UserTesting. “We know physical banking branches are closing in droves, yet the data here supports that consumers — especially in younger generations — crave the human-first benefits traditional banks provide.

“It’s important for digital banking platforms to consider the preferences and behaviors of their customers when building and designing products and services in order to meet this new need.”

While many said they prefer traditional banks, 67% said they still trust digital wallets and mobile banking apps – most popular amongst younger generations (76% of Gen Z and 86% of millennials) and least popular for baby boomers (48%).

Two in five (41%) prefer mobile payment apps as a way of sending money back and forth and 53% do so up to five times per month.

Six in 10 (60%) also admitted they’re more likely to spend money frivolously when using digital payment options.

Four in five (79%) digital bank users wished their banks offered some of the perks traditional banks already have — such as the 45% of them that wish online banks offered the ability to talk to humans for customer support.

Out of all the respondents surveyed, Gen Z rather talk to humans the most (60%), compared to the Silent generation (49%) and baby boomers (28%).

“In reality, there’s still an open space for hybrid institutions to exist,” concluded Bishop. “Both digital and traditional banking platforms have their exclusive benefits, but there is a clear want and need for institutions to exist in both physical and digital worlds, providing the shared perks either can offer.”

TOP 3 MONTHLY BUDGET SPENDS PER GENERATION

GEN Z

- Groceries - 48%

- Credit card debt - 41%

- Rent - 39%

MILLENNIAL

- Groceries - 55%

- Credit card debt - 46%

- Utilities - 44%

GEN X

- Groceries - 45%

- Rent/mortgage - 38%

- Utilities - 38%

BABY BOOMER

- Groceries - 47%

- Utilities - 43%

- Rent/mortgage - 31%

SILENT GENERATION

- Groceries - 45%

- Rent/mortgage - 43%

- Loans – 39%

Survey methodology:

This random double-opt-in survey of 1,800 Americans with bank accounts was commissioned by UserTesting between March 3 and April 12, 2023. It was conducted by market research company OnePoll, whose team members are members of the Market Research Society and have corporate membership to the American Association for Public Opinion Research (AAPOR) and the European Society for Opinion and Marketing Research (ESOMAR).