By Livy Beaner // SWNS

NEWS COPY W/ VIDEO + INFOGRAPHIC

More than seven in 10 employees think the American work setup is stuck in the 20th century, according to new research.

From the hours they work (54%) to even the way they’re paid (41%), a survey of 2,000 employed Americans revealed that it’s time to bring the workplace into the modern world.

Nearly 100 years after the inception of the Monday to Friday work week, 57% find that the traditional five-day, 9-5 no longer works for them.

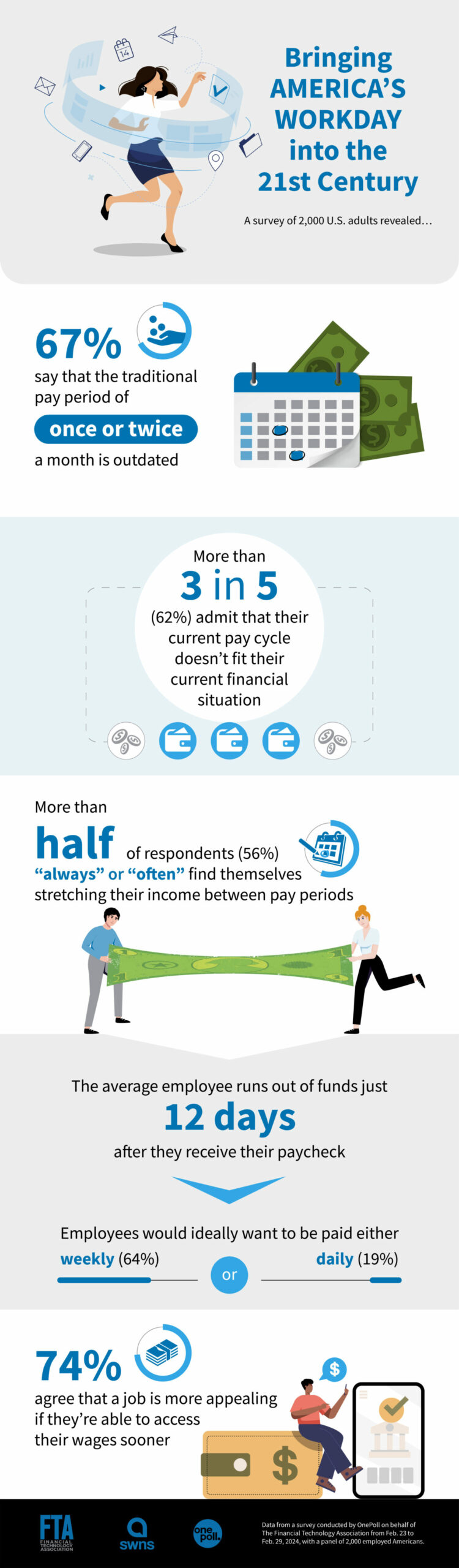

Not only that, but another 67% of respondents believe that the traditional pay period of once or twice a month is also outdated.

More than half (51%) also believe that a rigid structure is best left in the past and a lack of flexibility in the workplace is no longer up-to-date.

Conducted by OnePoll on behalf of the Financial Technology Association, the survey found that, if given the choice, employed Americans are more likely to opt for more frequent pay than a more flexible work schedule (50% vs 44%).

Currently, more than half (51%) are paid every other week, while 23% get their check weekly and 14% get one monthly. Only 7% of respondents are currently paid daily or after they complete their work.

More than three in five (62%) respondents revealed that their current pay cycle doesn’t fit their current financial situation and 61% believe it’s because they’re living paycheck to paycheck or because they run out of money too quickly (52%).

In fact, more than half of respondents (56%) “always” or “often” find themselves stretching their income between pay periods and the average employee runs out of funds just 12 days after they receive their paycheck.

In an ideal world and in order to suit their current financial situation, employees would want to be paid either weekly (64%) or daily (19%).

Results also found that more than one-third (35%) admit that they are unprepared for an unexpected $400 expense and another 59% believe that if their pay were to be delayed by as little as one week, they wouldn’t be able to afford necessities.

Over the last five years, respondents have missed credit card payments (28%), electric and gas payments (22%) and medical bill payments (20%) due to low funds. On top of that, one-quarter have skipped out on purchasing groceries for the same reason.

This means that they’ve had to seek out alternative sources of income, such as using credit cards (34%), working multiple jobs (31%) and borrowing money from family and friends (28%).

But even so, 30% of respondents would rather keep their financial struggles a secret and take out a high-interest loan instead of borrowing money from family and friends.

“It’s no secret that Americans across the country are struggling to make ends meet. With so many respondents living paycheck to paycheck, it’s time to find a modern solution,” said Penny Lee, President and Chief Executive Officer of the Financial Technology Association. “Earned wage access appeals to workers by letting them tap into wages they have already earned to make ends meet.”

Overall, 58% of respondents believed they would benefit from receiving their paycheck upon completing their daily work. Another 74% agree that a job is more appealing if they’re able to access their wages sooner.

However, results revealed that only 35% are familiar with the concept of “earned wage access,” which is a financial tool that allows employees to receive part or all of their paychecks before payday.

More than a quarter (27%) have access to an earned wage access program through their employer, though only 16% have actually used it.

But according to respondents, the concept of earned wage access is most appealing because it would reduce financial stress (24%), allow them to budget better (19%) or better prepare them for unexpected expenses (19%).

“Our payroll cycle is broken, and getting paid once or twice just doesn’t work for most Americans,” continued Lee. “People are opting for Earned Wage Access over other products on the market to meet their needs, budget responsibly and reduce financial stress.”

Survey methodology:

This random double-opt-in survey of 2,000 employed Americans was commissioned by The Financial Technology Association between Feb. 23 and Feb. 29, 2024. It was conducted by market research company OnePoll, whose team members are members of the Market Research Society and have corporate membership to the American Association for Public Opinion Research (AAPOR) and the European Society for Opinion and Marketing Research (ESOMAR).