By Marie Haaland // SWNS

NEWS COPY W/ VIDEO + INFOGRAPHIC

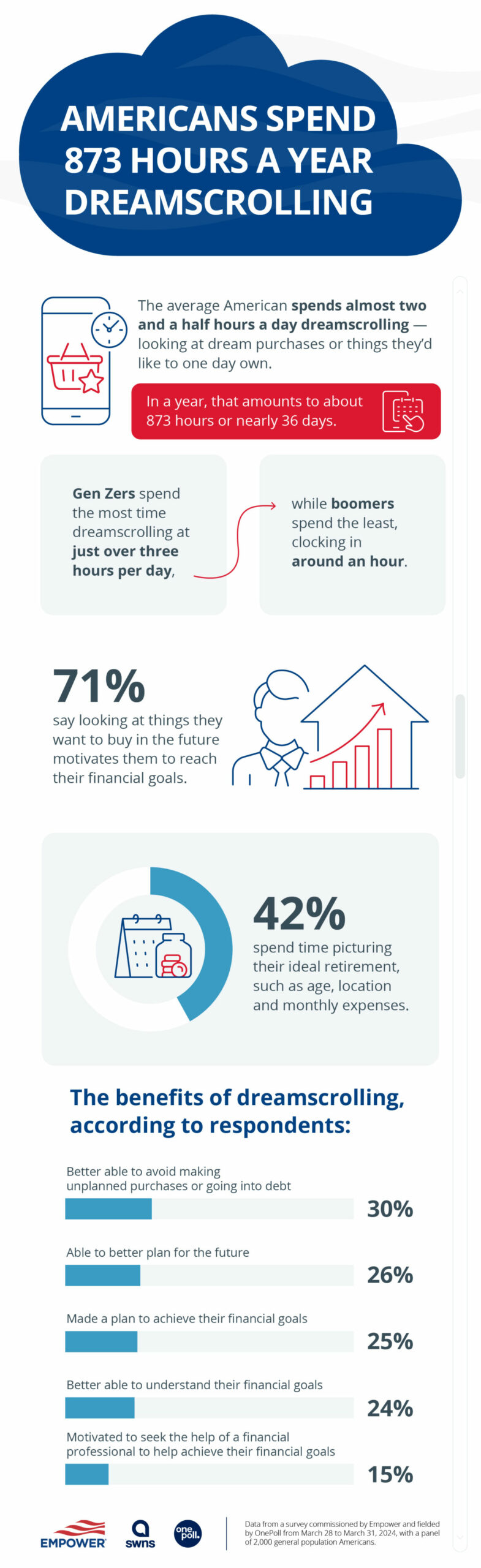

The average American spends nearly two and a half hours a day dreamscrolling — looking at dream purchases or things they’d like to one day own — and 71% say it’s time well spent, as the habit motivates them to reach their financial goals.

In a recent poll of 2,000 U.S. adults, more than two in five respondents say they spend more time dreamscrolling when the economy is uncertain (43%). In a year, that amounts to about 873 hours or nearly 36 days spent scrolling.

Conducted by OnePoll on behalf of financial services company Empower, the survey reveals half of respondents say they dreamscroll while on the job, and of those, one in five admit to spending between three and four hours a day multitasking while at work.

Gen Zers spend the most time dreamscrolling at just over three hours per day, while boomers spend the least, clocking in around an hour.

Survey respondents say looking at dream purchases makes it easier for them to be smart with their money (56%), avoid making unplanned purchases or going into debt (30%) and better plan to achieve their financial goals (25%).

Nearly seven in 10 see dreamscrolling as an investment in themselves (69%) and an outlet for them to envision what they want out of life (67%). Four in 10 respondents (42%) say they regularly spend time picturing their ideal retirement — including their retirement age, location and monthly expenses.

Scrolling for the American dream: one in five respondents are looking at homes or apartments (21%), while a quarter look at vacation destinations (25%), beauty or self-care products (23%), and items for their pet (19%).

Others spend time looking at clothing, shoes and accessories (49%); gadgets and technology (30%); and home décor or furniture (29%).

More than half (56%) currently have things left open in tabs and windows or saved in shopping carts that they’d like to purchase or own in the future. For those respondents, they estimate it would cost about $86,593.40 to afford everything they currently have saved.

Almost half of Americans say they are spending more time dreamscrolling now than did in previous years (45%) and 56% plan on buying something on their dream list before this year wraps.

While 65% are optimistic they’ll be able to one day buy everything on their list, nearly one in four say they don’t think they’ll ever be able to afford the majority of items (23%).

More than half (51%) say owning their dream purchases would make them feel more financially secure, and close to half say working with a financial professional would help them reach their goals (47%).

Others feel they have more work to do: 34% say they’ve purchased less things on their dream list than they should at their age, with millennials feeling the most behind (39%).

Top economic factors that may be holding some Americans back include rising prices (54%), inability to save money (29%) and growing debt (21%).

Instead of doom spending, dreamscrolling has had a positive impact on Americans’ money habits: respondents say they better understand their financial goals (24%) as a result.

HOW MUCH TIME DO RESPONDENTS SPEND DREAMSCROLLING?

- 4 hours per day

- 8 hours per week

- 6 hours per year

- 4 days per year

WHAT ARE AMERICANS DREAMSCROLLING FOR?

- Clothing, shoes and accessories (sneakers, purses, etc.) — 49%

- Picturing the ideal retirement – 42%

- Gadgets/technology (phone, computer, etc.) — 30%

- Home décor or furniture — 29%

- Vacation destinations/experiences (hotels, airfare, trending vacation destinations, etc.) — 25%

- Cars and/or auto accessories (buying a new car, new rims, window tints, etc.) — 24%

- Beauty/self-care products (makeup, skincare, etc.) — 23%

- Homes or apartments — 21%

- Jewelry (diamond bracelet, watches, etc.) — 21%

- Items for their pet(s)— 19%

- Tickets for experiences (sports games, concerts, food festival, etc.) — 18%

FINANCIAL BENEFITS OF DREAMSCROLLING

- I’ve been better able to avoid making unplanned purchases or going into debt — 30%

- I’ve been able to better plan for the future — 26%

- I’ve made a plan to achieve my financial goals — 25%

- I’ve been better able to understand my financial goals — 24%

- I’ve been motivated to seek the help of a financial advisor to help me achieve my goals — 15%

Survey methodology:

This random double-opt-in survey of 2,000 general population Americans was commissioned by Empower between March 28 and March 31, 2024. It was conducted by market research company OnePoll, whose team members are members of the Market Research Society and have corporate membership to the American Association for Public Opinion Research (AAPOR) and the European Society for Opinion and Marketing Research (ESOMAR).