By Marie Haaland // SWNS

NEWS COPY W/ VIDEO + INFOGRAPHIC

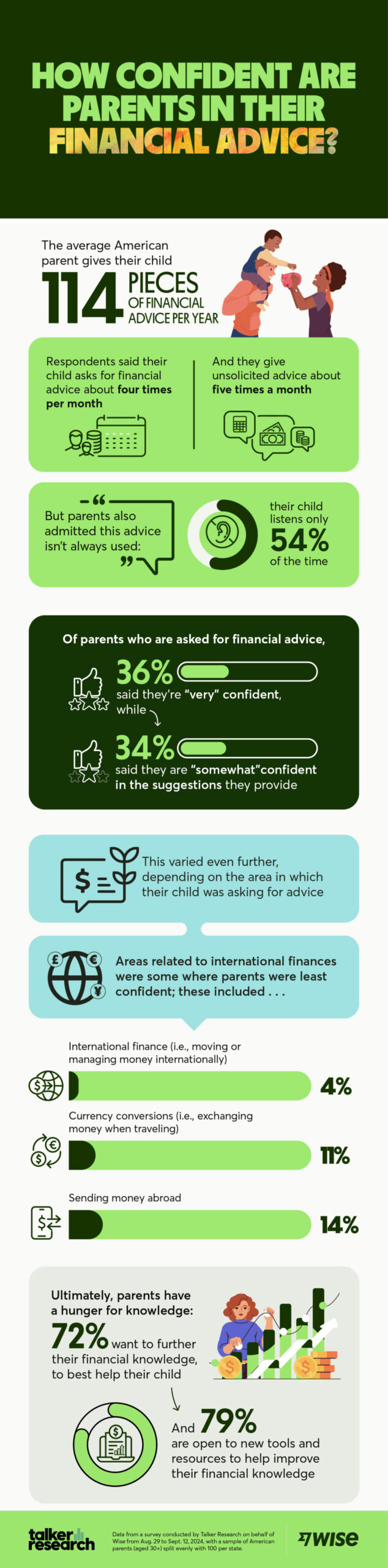

The average American parent offers their child 114 pieces of unique financial advice per year, according to new research.

However, parents admit their financial advice isn’t always used: respondents said their child listens only about half (54%) of the time.

A survey of 5,000 American parents — aged 30+ and split evenly by 100 individuals across all 50 states — uncovered this disconnect by asking respondents about the type of financial advice they give their children.

The research looked at different areas parents feel strong — or not — in their financial knowledge and how they’re seeking to improve the guidance they provide.

On average, respondents said their child asks for financial advice about four times per month. While this may open the door for conversation, parents surveyed also give unsolicited advice about five times a month, adding up to over 100 tips shared per year.

In the survey conducted by Talker Research on behalf of the international money app Wise, the findings showed that parents’ confidence levels vary in the advice they’re giving to their child.

Of those who are asked for financial advice, 36% said they’re “very” confident, while 34% said they are “somewhat” confident in the suggestions they provide.

Of course, the range of topics parents are asked for advice on impacts their ability to counsel their child.

Parents were the least confident in their ability to offer advice when it comes to moving and managing money outside the U.S. From a list of 15 different financial areas, parents had the lowest confidence in assisting their child with international finance (4%).

They also lacked confidence in currency conversion (11%) and sending money abroad (14%).

On the other hand, a majority of parents noted higher confidence in helping their child with budgeting their money (55%), managing savings options (52%) and navigating credit cards (41%), as well as understanding debt (32%) and credit scores (32%).

“Parents have to manage countless complex conversations as they prepare a child for adulthood. Finances are certainly top of the list, and with varying levels of confidence depending on the banking topic at hand, international finance is one area where more education is essential,” said Ankita D'Mello, Principal Product Manager at Wise.

“As our lives become increasingly global, whether that’s a child studying abroad or sending money to family and friends in another country, the importance of managing money across borders is only becoming more of a mainstay for parents and their kids.”

Regardless of their confidence levels in different financial topics, 40% of parents surveyed shared concerns their kids will “outgrow” the advice they are equipped to give. It’s why many of those surveyed said they’re interested in learning more about financial topics, including international finance and related areas (19%).

For parents surveyed who want to learn more about topics related to international finance, it’s because they’re generally interested in it (36%), and they believe it’s important knowledge to have as the world becomes increasingly interconnected (32%). Some want to learn more as either they (30%) or their child (22%) are hoping to travel internationally, or because it’s an area of their knowledge they think is lacking (27%).

Whether parents want to learn more about international finance or other topics, one thing is abundantly clear: 72% want to further their financial knowledge to better help their children.

Why this uptick in appetite for financial knowledge? This may be due to the changing nature of how we manage our finances, as nearly three-quarters (74%) of respondents believe it’s become more complicated since they were a child.

When asked why they believe financial management has become more complicated, 48% of these respondents noted the internet makes it easy to search for financial information, but it’s hard to know what to trust.

Ultimately, this hunger for knowledge is contributing to a thirst for information, as nearly half of parents surveyed (46%) believe they have more to learn about financial management.

This might be why the vast majority (79%) of parents said they’re open to new tools and resources to help them improve their financial knowledge, and nearly a quarter (22%) actively look for new services to use.

“Parents looking to grow their financial expertise don't have to go at it alone, especially those who want their kids to listen to them more. Leveraging tools built specifically to solve multifaceted financial problems, like international payments, is a great way to more easily navigate services that are traditionally challenging to understand,” said D’Mello. “With more financial information available now than ever before, it’s essential to work with providers that are established, affordable, convenient and transparent, especially when looking to move money internationally.”

HOW CONFIDENT ARE PARENTS, WHEN HELPING THEIR CHILD IN THESE FINANCIAL AREAS?

- Budgeting — 55%

- Savings options — 52%

- Credit cards — 41%

- Managing debt — 32%

- Managing credit score — 32%

- Insurance — 29%

- Financing a car — 29%

- Investments — 21%

- Mortgages — 16%

- Retirement planning (Roth vs. traditional IRAs, etc.) — 16%

- High-yield savings accounts — 15%

- Sending money abroad (i.e., sending money to friends or family internationally) — 14%

- Taking out/refinancing loans — 13%

- Currency conversions (i.e., exchanging money when traveling) — 11%

- International finance (i.e., moving or managing money internationally) — 4%

Survey methodology:

Talker Research surveyed American parents (aged 30+) split evenly with 100 per state. The survey was commissioned by Wise and administered and conducted online by Talker Research between Aug. 29 and Sept. 12, 2024.

We are sourcing from a non-probability frame and the two main sources we use are:

- Traditional online access panels — where respondents opt-in to take part in online market research for an incentive

- Programmatic — where respondents are online and are given the option to take part in a survey to receive a virtual incentive usually related to the online activity they are engaging in

Those who did not fit the specified sample were terminated from the survey. As the survey is fielded, dynamic online sampling is used, adjusting targeting to achieve the quotas specified as part of the sampling plan.

Regardless of which sources a respondent came from, they were directed to an Online Survey, where the survey was conducted in English; a link to the questionnaire can be shared upon request. Respondents were awarded points for completing the survey. These points have a small cash-equivalent monetary value.

Cells are only reported on for analysis if they have a minimum of 80 respondents, and statistical significance is calculated at the 95% level. Data is not weighted, but quotas and other parameters are put in place to reach the desired sample.

Interviews are excluded from the final analysis if they failed quality-checking measures. This includes:

- Speeders: Respondents who complete the survey in a time that is quicker than one-third of the median length of interview are disqualified as speeders

- Open ends: All verbatim responses (full open-ended questions as well as other please specify options) are checked for inappropriate or irrelevant text

- Bots: Captcha is enabled on surveys, which allows the research team to identify and disqualify bots

- Duplicates: Survey software has “deduping” based on digital fingerprinting, which ensures nobody is allowed to take the survey more than once

It is worth noting that this survey was only available to individuals with internet access, and the results may not be generalizable to those without internet access.