By Vanessa Mangru-Kumar // SWNS

NEWS COPY W/ VIDEO + INFOGRAPHIC

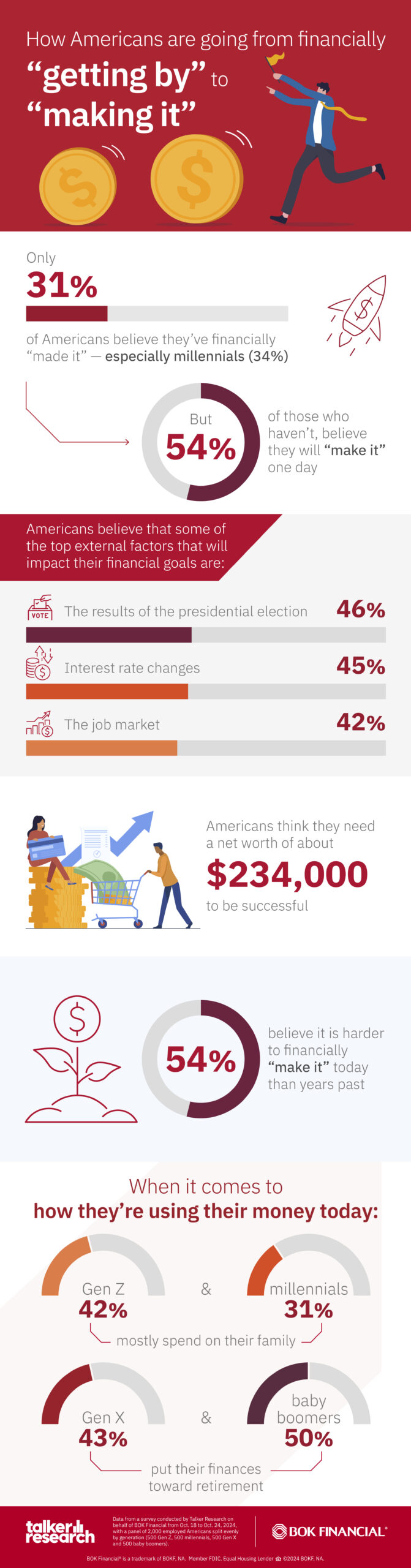

Less than one-third of Americans (31%) think they’ve financially “made it” in life, according to new research.

A survey of 2,000 employed Americans split evenly by generation revealed that of those who don’t think they’re there yet, a little more than half (54%) believe that they are well on their way and will financially “make it” in their lifetime.

Interestingly, more millennials than any other generation (34%) believe they’ve already made it.

However, getting older isn’t always easier: only 27% of baby boomers believe they’ve reached financial success and, of those who have not, only a third believe they someday will.

What’s holding them back? Conducted by Talker Research for BOK Financial, survey results found that Americans believe external factors will impact their financial goals: the results of the presidential election (46%), interest rate changes (45%) and the job market (42%).

Eight in 10 say their own definition of “making it financially” has evolved over time (79%) and the average net worth identified to financially “make it” is about $234,000.

Half of those surveyed said that considering how their parents described finances when they entered adulthood, it’s harder to make it financially today than before (54%).

“The uncertainty around the economy, politics and other external factors can weigh heavily on people — and are right now,” said Jessica Jones with BOK Financial Advisors, an affiliate of BOK Financial. “And financial headwinds like high inflation and interest rates can make it feel like it’s harder to get ahead, but baby steps are key. If someone is struggling to see success in their financial future, it’s important to just get started, even with a small savings account.”

Today, financially “making it” comes with its own barriers; according to respondents, some of those include high cost of living (42%) and inflation (26%) or even their own personal spending habits (7%).

Surprisingly, nearly half of baby boomers (48%) and Gen X respondents (47%) cite a higher cost of living as more of a barrier compared to Gen Z (34%).

On the other hand, Gen Z (28%) and millennial (30%) respondents were the most likely to account for inflation impacting them.

And not only is “making it” more difficult to achieve, the results look entirely different from previous generations.

According to the survey, owning a home (78%) or vehicle (64%) are necessary to be financially successful today, whereas having children (40%) or getting married (34%) were key indicators for their parents that aren’t as important now.

Earning a college degree (30%) as well as having an established long-standing career (48%) are also more in line with modern financial success than that of respondents’ parents.

When it comes to how they’re using their money today, Gen Z (27%) and millennials (31%) said the greatest sum of their money is spent on their family, while Gen X (43%) and baby boomers (50%) are putting their finances toward retirement above all.

For others, being able to afford planning for retirement will come later: at about 41 years old for Gen Zers and 46 years old for millennial respondents.

Although they’re spending on their loved ones, Gen Z are keeping their own needs in mind, too.

They had the highest percentage of respondents who said that they’re best off using their money to purchase items that make them happy (20%).

Even though the older generation prioritizes using money practically, baby boomers were the least confident in their financial future during retirement (33%) and their ability to plan for the future without any professional help (49%); Gen Z is most confident in being able to do so (70%).

“While people may feel confident that they can manage money on their own, I’d really advocate for being educated,” Jones said. “Young people, especially, are showing an interest in understanding financial concepts, which is encouraging, but there is a lot of information out there, so I encourage people to double check their sources.”

With all the learning to be done, Americans are more interested in hearing from those who are older than them than they are their own peers (64% vs 56%) when it comes to financial advice.

Though respondents are less interested in financial advice from social media (41%), 45% say social platforms influence their perceptions of what it means to make it financially.

Gen Z expressed the most interest in getting financial advice from social media (64%) and, in turn, were the likeliest to say it influences their perception of what it means to “make it” financially.

Survey methodology:

Talker Research surveyed 2,000 employed Americans split evenly by generation (500 Gen Z, 500 millennials, 500 Gen X and 500 baby boomers); the survey was commissioned by BOK Financial and administered and conducted online by Talker Research between Oct. 18 and Oct. 24, 2024.

We are sourcing from a non-probability frame and the two main sources we use are:

- Traditional online access panels — where respondents opt-in to take part in online market research for an incentive

- Programmatic — where respondents are online and are given the option to take part in a survey to receive a virtual incentive usually related to the online activity they are engaging in

Those who did not fit the specified sample were terminated from the survey. As the survey is fielded, dynamic online sampling is used, adjusting targeting to achieve the quotas specified as part of the sampling plan.

Regardless of which sources a respondent came from, they were directed to an Online Survey, where the survey was conducted in English; a link to the questionnaire can be shared upon request. Respondents were awarded points for completing the survey. These points have a small cash-equivalent monetary value.

Cells are only reported on for analysis if they have a minimum of 80 respondents, and statistical significance is calculated at the 95% level. Data is not weighted, but quotas and other parameters are put in place to reach the desired sample.

Interviews are excluded from the final analysis if they failed quality-checking measures. This includes:

- Speeders: Respondents who complete the survey in a time that is quicker than one-third of the median length of interview are disqualified as speeders

- Open ends: All verbatim responses (full open-ended questions as well as other please specify options) are checked for inappropriate or irrelevant text

- Bots: Captcha is enabled on surveys, which allows the research team to identify and disqualify bots

- Duplicates: Survey software has “deduping” based on digital fingerprinting, which ensures nobody is allowed to take the survey more than once

It is worth noting that this survey was only available to individuals with internet access, and the results may not be generalizable to those without internet access.