By Vanessa Mangru-Kumar // SWNS

NEWS COPY W/ VIDEO + INFOGRAPHIC

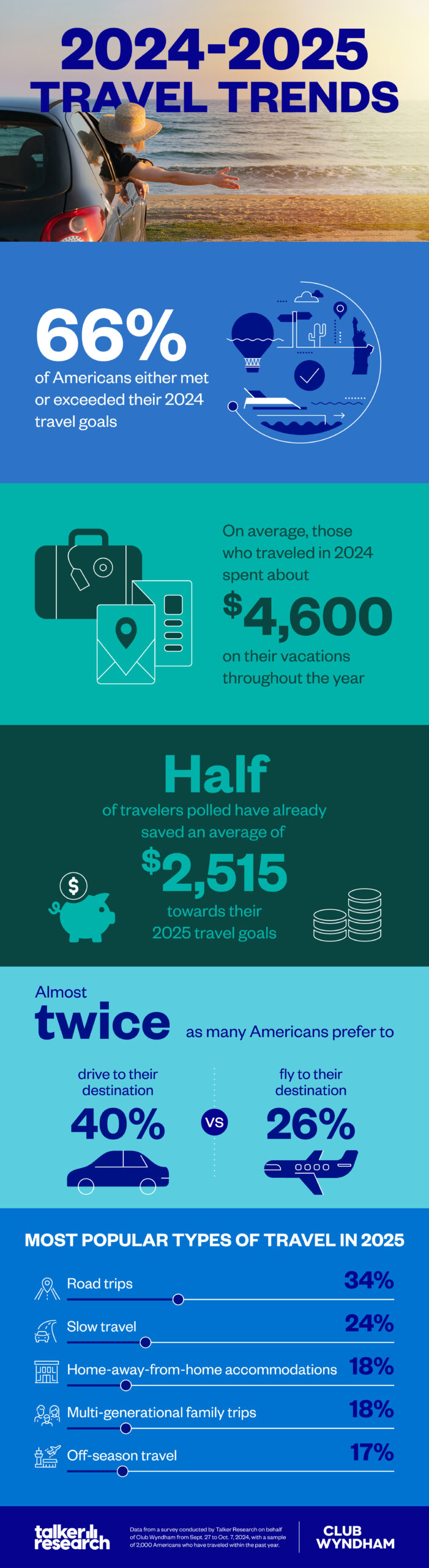

Two-thirds of Americans either met or exceeded their 2024 travel goals, according to new research.

A survey of 2,000 U.S. adults who have traveled within the past year revealed that while 43% traveled just as much as they planned to over the last 12 months, 23% actually exceeded that goal.

The survey examined the travel choices, habits and trends that defined their 2024 trips and preferences that will shapeshift the 2025 travel season.

The average American traveler took three trips in 2024, two of which were well-planned at least a month in advance, with the other being spontaneous.

For each trip this year, respondents spent an average of $1,532 when traveling alone; this price tag was slightly higher when vacationing with others: $1,598. This totals about $4,600 spent on all vacations in 2024.

Conducted by Talker Research for Club Wyndham, the survey found that in taking a closer look at 2025, seven in 10 travelers are planning to continue their adventures and travel just as much, if not more.

To achieve their 2025 travel goals, half of the respondents have money saved up for traveling next year, averaging $2,515; one in seven have over $5,000 saved up for future trips.

“With Americans planning to travel just as much or even more in 2025 despite rising travel costs, accessibility and affordability are more important than ever,” said Annie Roberts, senior vice president of club and owner services, Club Wyndham. “For travelers prioritizing value, timeshares provide a lifetime of vacations in spacious multi-bedroom accommodations, which is something you just can’t experience at a traditional hotel.”

After their trips this year, these experienced travelers know what they like. Almost twice as many respondents prefer to drive to vacation destinations than fly (40% vs. 26%).

Road trips were the most popular form of travel in 2024 (40%), along with slow travel (traveling without a plan) (22%) and multi-generational family trips (traveling with several generations of family) (21%).

In fact, road trips are still topping the charts and are set to be amongst the hottest travel trends for 2025 with 34% of travelers reporting they are planning to take one. Microcations (trips that are four days or less) will also continue to be popular in 2025, as 17% plan to take a quick trip.

The theme of traveling with family will also carry over into 2025, as a majority of American travelers plan to prioritize taking a family vacation in the next year (61%).

Similarly, nearly half of the respondents said the person they’ll mostly travel with in 2025 is their partner (46%). As a result, solo travel will be slightly less popular next year than in 2024 (14% vs. 18%), but is still the second-most favored option.

Home-away-from-home travel (18%) and off-season travel (17%) are rising trends and will increase in popularity.

“The anticipated rise of home-away-from-home travel in 2025, along with the continued interest in trends like road tripping and multi-generational travel, demonstrate that Americans want to prioritize comfort, adventure and connection while on vacation with their loved ones next year,” added Annie Roberts from Club Wyndham.

Looking more specifically at where they’ll go, a quarter of Americans are more interested in traveling near their home (24%), as 60% believe they have not seen enough of the cities or attractions throughout the United States.

When they chose where to vacation in 2024, the factors that held the most importance were the destination itself (53%), cost (48%) and the experiences or activities available (30%).

In 2025, priorities have shifted slightly; cost will be the driving factor (52%), with destination coming second (49%).

A majority of those surveyed prefer to have something to look forward to by spacing their trips out throughout the year (58%), but nearly a third revealed that they like to do the bulk of their travel during a certain time period (28%).

According to travelers, the most popular months for travel in 2025 will be June (28%) and July (27%), while others will look to travel in colder months like March (16%) or December (15%).

Those who indicated that they would travel in one of the common off-peak months said that weather plays a major factor (42%), along with traveling for celebrations (28%).

Avoiding crowds was also a big reason for choosing to travel in the off-season (27%).

For 30%, the next vacation is just around the corner, as they revealed plans to take their first trip before spring.

POPULAR TRAVEL TRENDS FOR 2025

- Road trips — 34%

- Slow travel — 24%

- Home-away-from-home (visiting somewhere that offers the comforts of home in a new destination) — 18%

- Multi-generational family trips — 18%

- Off-season travel — 17%

- Microcations (trips that are four days or less) — 17%

- Immersive travel (having intimate, local interactions and authentic cultural experiences) — 16%

- “Experience economy” (Visiting a location because of the experiences, not the destination) — 15%

- Solo travel — 14%

- Staycations (traveling very close to home) — 13%

Survey methodology:

Talker Research surveyed 2,000 people who have traveled within the past year; the survey was commissioned by Club Wyndham and administered and conducted online by Talker Research between Sept. 27 and Oct. 7, 2024.

We are sourcing from a non-probability frame and the two main sources we use are:

- Traditional online access panels — where respondents opt-in to take part in online market research for an incentive

- Programmatic — where respondents are online and are given the option to take part in a survey to receive a virtual incentive usually related to the online activity they are engaging in

Those who did not fit the specified sample were terminated from the survey. As the survey is fielded, dynamic online sampling is used, adjusting targeting to achieve the quotas specified as part of the sampling plan.

Regardless of which sources a respondent came from, they were directed to an Online Survey, where the survey was conducted in English; a link to the questionnaire can be shared upon request. Respondents were awarded points for completing the survey. These points have a small cash-equivalent monetary value.

Cells are only reported on for analysis if they have a minimum of 80 respondents, and statistical significance is calculated at the 95% level. Data is not weighted, but quotas and other parameters are put in place to reach the desired sample.

Interviews are excluded from the final analysis if they failed quality-checking measures. This includes:

- Speeders: Respondents who complete the survey in a time that is quicker than one-third of the median length of interview are disqualified as speeders

- Open ends: All verbatim responses (full open-ended questions as well as other please specify options) are checked for inappropriate or irrelevant text

- Bots: Captcha is enabled on surveys, which allows the research team to identify and disqualify bots

- Duplicates: Survey software has “deduping” based on digital fingerprinting, which ensures nobody is allowed to take the survey more than once

It is worth noting that this survey was only available to individuals with internet access, and the results may not be generalizable to those without internet access.