By Joseph Staples // SWNS

NEWS COPY W/ VIDEO + INFOGRAPHIC

Too much of a good thing? Streaming service subscribers report that content overload and hidden fees are leading to frustration and subscription fatigue.

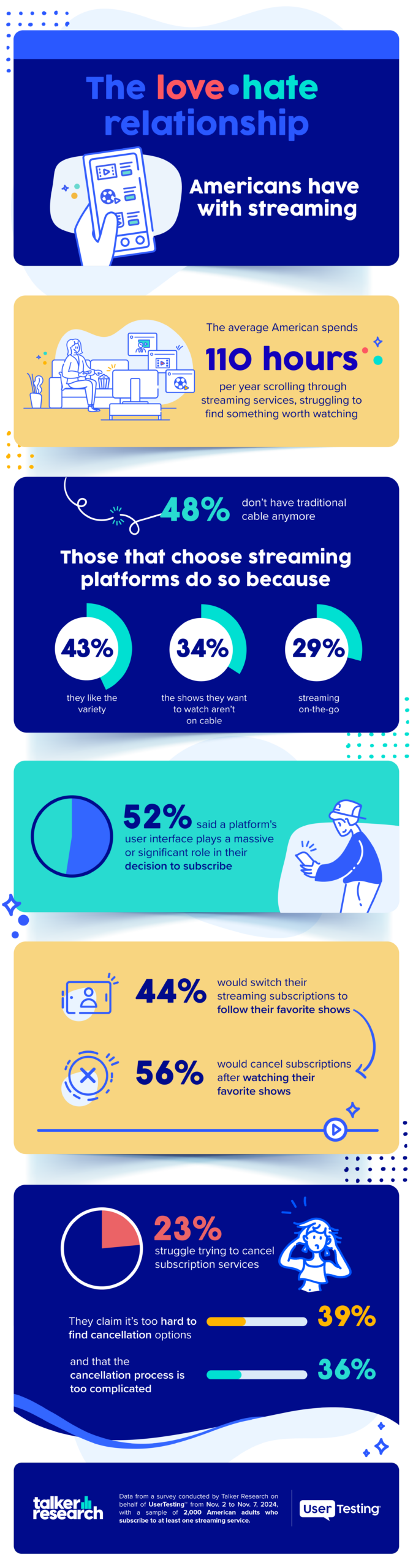

In fact, the new survey of 2,000 American streaming service subscribers revealed that the average person spends 110 hours per year scrolling through streaming services, struggling to find something worth watching — a stark reminder of the “too much content, too little time” dilemma.

Commissioned by UserTesting and conducted by Talker Research, the study revealed one in five believe it’s harder to find something to watch today than it was 10 years ago. According to them, the underlying cause comes from being overwhelmed by too much content.

Many struggled with having larger content libraries (41%) and feeling like there’s too much original content being produced (26%).

And although 75% appreciate streaming service algorithms serving them accurate recommendations, 51% admitted the quantity of recommended content is also overwhelming, explaining they want to watch everything recommended to them.

Nearly half (48%) do not have traditional cable anymore. And those that choose streaming platforms do so because they like the variety (43%), the shows they want to watch are not on cable (34%), and they find streaming more convenient for on-the-go viewing (29%).

However, people are generally dissatisfied with the current streaming services available. In fact, 51% would rather have more streaming service options — even if those options included ads.

When asked what their “dream” streaming platform would look like, top features included premium channels and networks for no added cost (40%) and an easy-to-navigate interface (39%).

Further, 52% said a platform’s user interface plays a massive or significant role in their decision to subscribe.

The average person said all of the above should be available for no more than $46 per month — although 11% admitted they’d willingly pay over $100 per month for the service.

"The streaming landscape has evolved from solving the problem of content access to creating a new challenge of content discovery," said Bobby Meixner, Senior Director of Industry Solutions at UserTesting. "Our research shows that despite advanced recommendation algorithms, viewers are spending nearly five full days each year just trying to decide what to watch–time that could be spent actually enjoying content."

The study also found a number of frustrations streaming subscribers have experienced.

A substantial 79% expressed frustration with streaming services requiring additional subscription fees for select content.

When encountering those added fees, the majority (59%) are unlikely to pay and would instead look for content on a different platform they subscribe to (73%), give up and watch something else (77%) or consider canceling their subscription altogether (37%). Nearly one in five (19%) would sign up for a free trial of a platform to find a show they want to watch.

Respondents also showed disdain for platforms pulling shows without notice, which directly impacts loyalty.

Over the past year, 69% have opened a streaming service at least once to find the show they were looking for is no longer there.

Forty-four percent said they would likely end their subscription to a streaming service and subscribe to a new one just to continue watching a favorite show, and 56% would cancel that subscription as soon as they finish watching said show.

But when canceling, nearly a quarter (23%) have experienced difficulties, claiming it’s hard for them to find the cancellation option on the platform’s website (39%) or that the cancellation process was overly-complicated with multiple steps (36%).

"We’re seeing a fundamental shift in how streaming platforms need to approach user experience," continued Bobby Meixner. "With 52% of subscribers saying interface design significantly impacts their subscription decisions, and 79% frustrated by hidden fees, streaming services must balance content abundance with accessibility and transparency to maintain subscriber loyalty."

Survey methodology:

Talker Research surveyed 2,000 American adults who subscribe to at least one streaming service; the survey was commissioned by UserTesting and administered and conducted online by Talker Research between Nov. 2 and Nov. 7, 2024.

We are sourcing from a non-probability frame and the two main sources we use are:

- Traditional online access panels — where respondents opt-in to take part in online market research for an incentive

- Programmatic — where respondents are online and are given the option to take part in a survey to receive a virtual incentive usually related to the online activity they are engaging in

Those who did not fit the specified sample were terminated from the survey. As the survey is fielded, dynamic online sampling is used, adjusting targeting to achieve the quotas specified as part of the sampling plan.

Regardless of which sources a respondent came from, they were directed to an Online Survey, where the survey was conducted in English; a link to the questionnaire can be shared upon request. Respondents were awarded points for completing the survey. These points have a small cash-equivalent monetary value.

Cells are only reported on for analysis if they have a minimum of 80 respondents, and statistical significance is calculated at the 95% level. Data is not weighted, but quotas and other parameters are put in place to reach the desired sample.

Interviews are excluded from the final analysis if they failed quality-checking measures. This includes:

- Speeders: Respondents who complete the survey in a time that is quicker than one-third of the median length of interview are disqualified as speeders

- Open ends: All verbatim responses (full open-ended questions as well as other please specify options) are checked for inappropriate or irrelevant text

- Bots: Captcha is enabled on surveys, which allows the research team to identify and disqualify bots

- Duplicates: Survey software has “deduping” based on digital fingerprinting, which ensures nobody is allowed to take the survey more than once

It is worth noting that this survey was only available to individuals with internet access, and the results may not be generalizable to those without internet access.