By Joseph Staples // SWNS

NEWS COPY W/ VIDEO + INFOGRAPHIC

Hold onto your wallets: Most Americans say cash is outdated — with many crowning their credit cards as their go-to for everything from everyday groceries to fully loaded vacations.

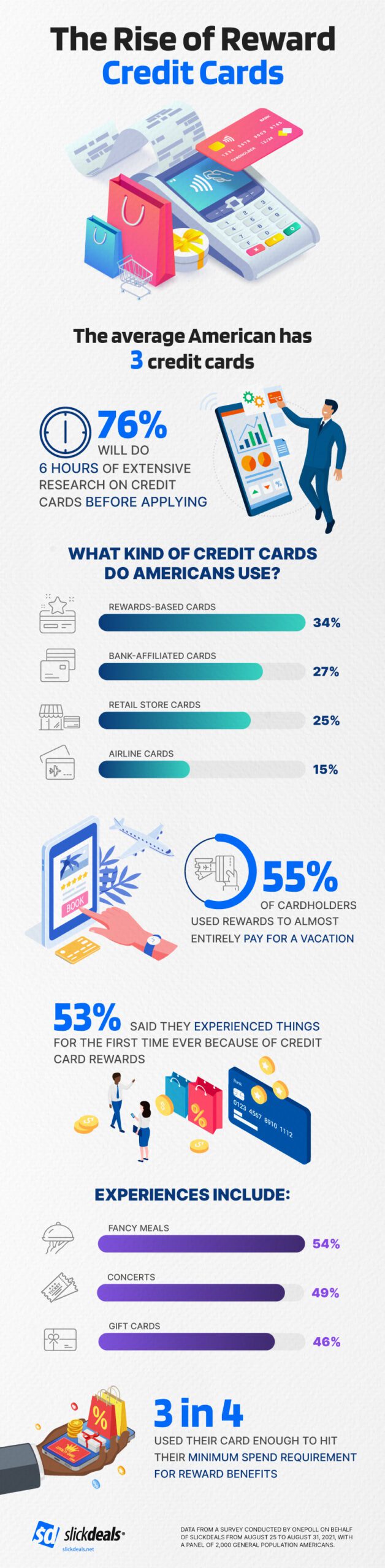

A survey of 2,000 Americans found the average person has three credit cards to their name, with only a third (32%) paying their bill in full every month.

Two in five respondents said they use their credit card as frequently as a few times per week, with more than half using it on large and everyday expenses (52%). Other popular credit uses include travel (47%), restaurant dining (45%), and vacations (43%).

Spending with their cards does come with rewarding benefits, though.

Fifty-five percent of cardholders have used rewards to almost entirely pay for a vacation, including cashing in on airline points for five-hour flights on average.

Commissioned by Slickdeals and conducted by OnePoll, the study found that over half (53%) of respondents experienced things for the first time because of their credit card’s rewards.

First-time experiences include fancy meals (54%), concerts (49%), and $100 gift cards (46%).

Three in four (74%) Americans use their credit card enough to hit the minimum spend requirement to get reward benefits and points.

To maximize their benefits, 76% will do extensive research on credit cards before applying, spending an average of six hours researching a single card.

Several things go into consideration when looking for the right card: 86% pay special attention to annual fees when signing up for a credit card, and 78% will even weigh the benefits of their credit card against the annual fee.

Forty-eight percent of respondents said they have applied for a credit card within the last year. Some motivators to get one included wanting to take advantage of the rewards program (61%), wanting lower interest rates (50%) and having less cash on hand (46%).

An average $757 has been saved by using credit card rewards in the past year.

“Credit cards aren’t just another way to pay for your purchases. If you choose the right rewards cards and you’re strategic about how you use them, you can earn tremendous benefits such as free flights, hotel stays or even cashback,” said Louie Patterson, senior personal finance editor at Slickdeals.

Three in four people said they’re more likely to shop from a certain brand if they get better credit card rewards from shopping there.

Some recalled the best rewards they’ve had from their card — new TVs, free vacations, gaming consoles, gas discounts, and international flights to places like the Philippines and South America.

Three in five have used their credit cards more in the past year than ever before, mostly to pay for things at a later date (33%) or collect rewards (30%).

“Once you’ve done the research on the right rewards card for you, there are a number of ways to maximize the benefits. Make sure you pay off the balance in full, look for opportunities to pay with your card for monthly fees such as insurance, cable and cell phone bills, and be on the lookout for opportunities to earn bonus points, which may be awarded for specific types of purchases,” Patterson added. “Our personal finance editorial team, along with our community of users, is always scouting out the best cards and tips to ensure savvy shoppers can reap the rewards.”

WHAT DO AMERICANS USE CREDIT CARDS FOR?

- Everyday purchases 52%

- Large purchases 52%

- Travel 47%

- Restaurant dining 45%

WHAT KINDS OF CREDIT CARDS DO AMERICANS USE?

- Rewards-based cards 34%

- Bank-affiliated cards 27%

- Retail store cards 25%

- Airline cards 15%