By Joseph Staples // SWNS

Is the future generation of homeowners set up to fail?

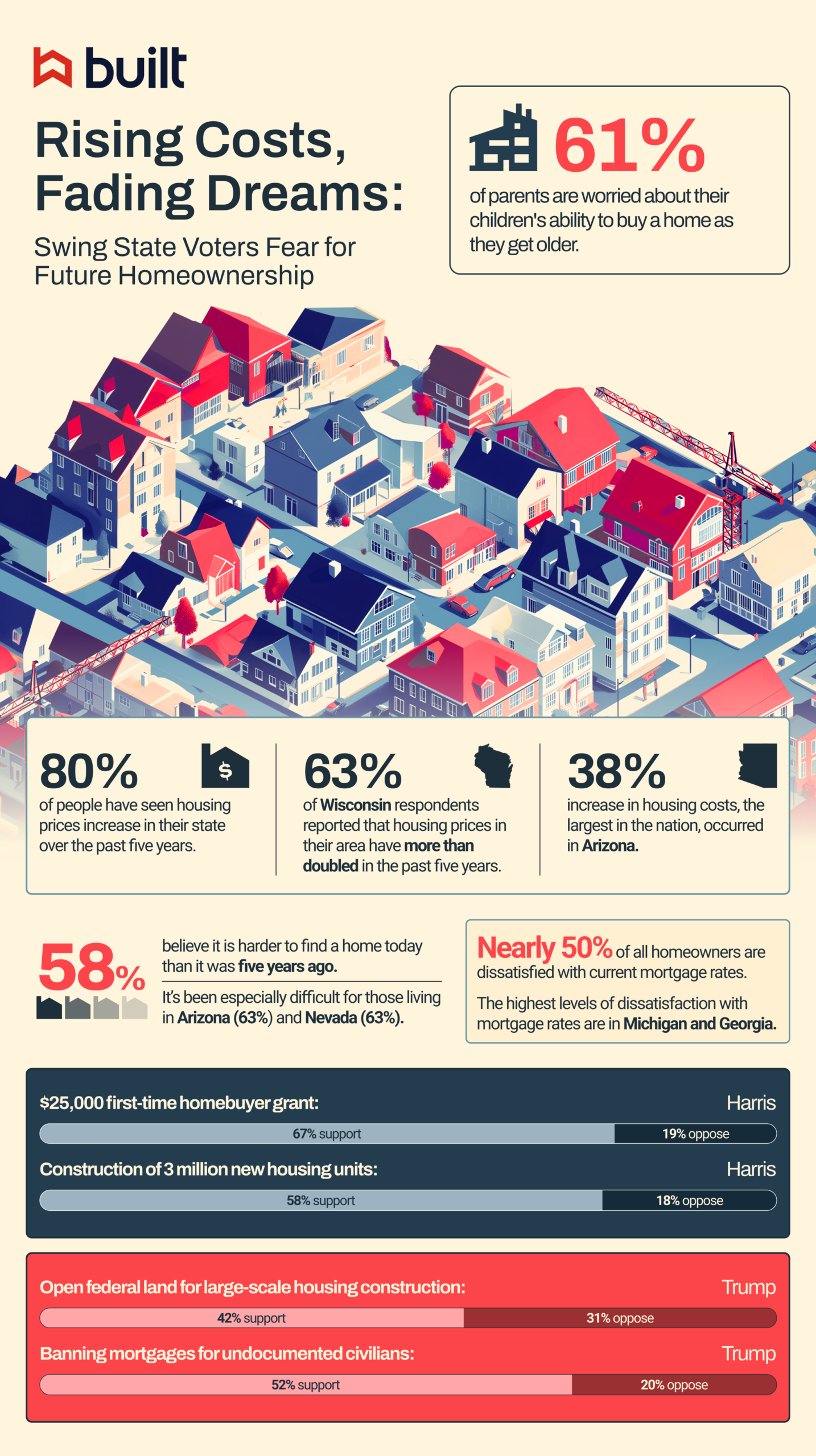

Ahead of the upcoming U.S. presidential election, a new study of 1,000 adults from the seven swing states found 61% of parents polled are worried about whether their children will be able to buy a home as they get older.

Over the past five years, 80% of adults in Arizona, Georgia, Michigan, North Carolina, Nevada, Pennsylvania and Wisconsin have seen housing prices increase in their state, averaging a 33% increase.

Arizona has seen the steepest housing cost increase at 38%, while Wisconsin saw the least (27%).

The research, commissioned by Built, a real estate and construction finance and management platform, and conducted by Talker Research, revealed 58% believe it is harder to find a home today than it was five years ago. It was found to be especially difficult for those polled who are living in Arizona (63%) and Nevada (63%).

And many believe it’s been caused by overall inflation (59%), rent increases (40%), interest rate increases (31%), not enough residential housing being available (28%), and increased property tax rates (28%).

Nearly half (46%) of homeowners said they were dissatisfied with current mortgage rates, with dissatisfaction reaching a high of 48% in Michigan and Georgia.

Respondents were asked whether they feel various levels of government are taking adequate responsibility in addressing housing issues. Nearly a third (30%) believe their city government is doing enough.

However, many think more action is needed at different levels of government: 48% feel their city could do more, 53% believe their state should step up, and 57% say the federal government isn’t doing enough.

“With housing affordability top of mind for voters, political candidates won’t be able to sidestep the pressure to deliver real, actionable solutions,” said Built CEO Chase Gilbert. “With 10% of all U.S. residential construction spend managed on our platform, we have a front-row seat to the factors speeding up housing development nationwide.

“As voters head to the polls, especially in key swing states, housing will be a pivotal issue. The right combination of tools and policies can break down barriers, ensuring homes get built faster and more efficiently to meet the growing demand.”

Respondents were also asked whether they were in favor or were against certain policies proposed from the two major party presidential candidates.

The results of the survey reveal broad support for both major candidates' housing policies, with stronger majorities backing Vice President Harris' initiatives.

A 67% majority supports Harris' proposal for a $25,000 first-time homebuyer grant, with only 19% opposed, and 58% favor the construction of 3 million new housing units, while just 18% oppose this plan.

In contrast, former President Trump’s housing policies face more division among respondents. Forty-two percent support the idea of opening federal lands for large-scale housing construction, but a significant 31% oppose it.

Similarly, 52% of respondents are in favor of banning mortgages for undocumented civilians, though 20% oppose this policy

Within their local elections, 51% believe an incoming, challenger candidate could do a better job addressing housing issues than the current incumbent.

Respondents shared which housing policies they would be in favor of if it were put into action in their local area: rent control (47%), caps on rent increases (45%), multi-family housing in single-family zones (26%), and increased residential development (26%).

Potential voters in each state shared just how much of an impact they believe the current presidential election will have on the housing market for them.

Over half of respondents from Georgia (54%) and Michigan (51%) said the results of the presidential election will have a “major impact” for them. Meanwhile, 40% of North Carolina and Wisconsin residents agreed it will have a “moderate” impact for them.

Pennsylvania was the least concerned — 28% said the election has “little to no” impact on their state’s housing market.

“During an election year, the spotlight on policies and promises sharpens,” said Gilbert. “Housing costs are front and center for millions of Americans, and rightly so. The past five years have forced many to rethink their cost of living and whether homeownership is even within reach anymore — no matter which side of the aisle they’re on.”

Survey methodology:

Talker Research surveyed 1,000 Americans from swing states (Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania, and Wisconsin); the survey was commissioned by Built and administered and conducted online by Talker Research between Sept. 24 and Sept. 30, 2024.

We are sourcing from a non-probability frame and the two main sources we use are:

- Traditional online access panels — where respondents opt-in to take part in online market research for an incentive

- Programmatic — where respondents are online and are given the option to take part in a survey to receive a virtual incentive usually related to the online activity they are engaging in

Those who did not fit the specified sample were terminated from the survey. As the survey is fielded, dynamic online sampling is used, adjusting targeting to achieve the quotas specified as part of the sampling plan.

Regardless of which sources a respondent came from, they were directed to an Online Survey, where the survey was conducted in English; a link to the questionnaire can be shared upon request. Respondents were awarded points for completing the survey. These points have a small cash-equivalent monetary value.

Cells are only reported on for analysis if they have a minimum of 80 respondents, and statistical significance is calculated at the 95% level. Data is not weighted, but quotas and other parameters are put in place to reach the desired sample.

Interviews are excluded from the final analysis if they failed quality-checking measures. This includes:

- Speeders: Respondents who complete the survey in a time that is quicker than one-third of the median length of interview are disqualified as speeders

- Open ends: All verbatim responses (full open-ended questions as well as other please specify options) are checked for inappropriate or irrelevant text

- Bots: Captcha is enabled on surveys, which allows the research team to identify and disqualify bots

- Duplicates: Survey software has “deduping” based on digital fingerprinting, which ensures nobody is allowed to take the survey more than once

It is worth noting that this survey was only available to individuals with internet access, and the results may not be generalizable to those without internet access.