By SWNS Staff // SWNS

NEWS COPY w/ VIDEO + INFOGRAPHIC

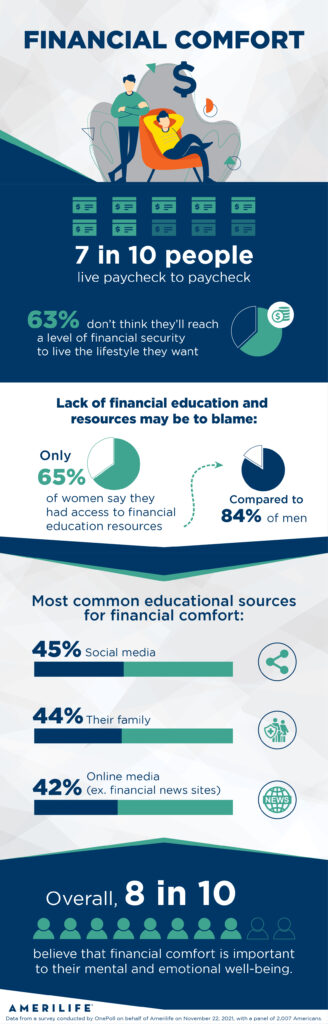

Seven in 10 Americans live paycheck to paycheck, new research suggests.

A recent survey of 2,007 U.S. respondents found that 63% don’t see themselves reaching a level of financial security that will allow them to live the lifestyle they want.

Lack of financial education and resources may be to blame, particularly for women, who were less likely to say they’d had access to them than men (65% vs. 84%).

To educate themselves en route to financial comfort, most turn to social media (45%), their family (44%) and online media such as financial news websites (42%).

Conducted by OnePoll on behalf of AmeriLife, the survey also explored the necessities for financial peace of mind among different groups.

While most women noted an absence of credit card debt (59%) as the most important requirement for financial comfort, the majority of men cited homeownership (58%).

Respondents also differed in what they considered to be essential for financial wellness. Seventy-nine percent of people earning over $150,000 found a savings account to be “very” important, compared to just 54% of those with an income of $60,000 to $89,999.

On average, respondents said they’d need $686 of disposable income per month to feel financially comfortable.

And when it comes to retirement, the average American plans to start thinking about it at age 40.

Yet seven in 10 said their understanding of personal financial comfort kept changing after they reached adulthood.

“Things don’t always go according to plan; no matter your income, having a budget is key,” said Denny Southern, president of annuities & retirement planning for AmeriLife. “If possible, a person should have six months of expenses readily available in savings. Once they achieve this, they can then target 30% of their income for things they want, and the remaining 20% for their savings. The earlier a person can do this, the further it will take them towards a comfortable retirement.”

Millennials (76%) were most likely to say that at some point in their adult life, a personal healthcare-related bill caused them to spend a large chunk of their savings. They also noted that keeping up with healthcare-related bills has derailed them from making other payments (70%), more so than any other age group.

For most of the millennial respondents, that sacrifice came in the form of a down payment or mortgage on a home (57% and 56%).

Regardless of age, the vast majority (82%) believe that financial comfort is important to their mental and emotional well-being.

“It’s important to know how to offset costs of both planned and unforeseen events,” said Frank Tebyani, president of career agency distribution for AmeriLife. “It’s not surprising to note, however and unfortunately, that only three in 10 respondents use financial advisors as a resource to educate themselves to attain financial comfort. "It's critical that we continue positioning financial advisors as a support system for people. It's a necessity to make the idea of financial comfort more accessible so people can consider their financial wellness more holistically."

ESSENTIALS FOR FINANCIAL COMFORT

- No credit card debt (57%)

- Good credit score (54%)

- Homeownership (53%)

- Residual/ancillary income (52%)

- Savings account/rainy day fund (52%)

- Being able to retire (51%)